Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Sales volumes, an often used indicator of demand, are as close to a property market crystal ball as it comes. For all of you who have been to one of our educational events, you’ll know that the philosophy of the right property in the right market at the right time is a guiding force. In today’s edition of the blog, I’ll take you through one of the components we assess to determine the right time for a property market.

Our research has shown that the most significant indicators of the future price trajectory of a capital city property market are the following:

Let’s focus on point one.

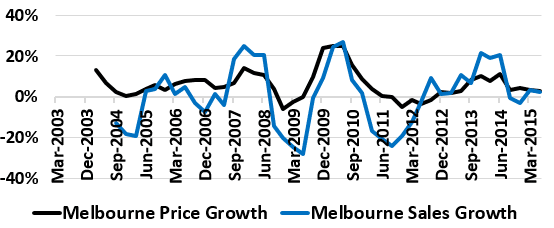

Sales volumes provide an effective measure of the depth of demand in a property market but, on face value at least, provide little predictive power. Earlier this month, however, we conducted analysis on the relationship between sales volumes and price growth, taking a 15 year sample to ensure multiple cycles were included. As shown below, there is a significant relationship (i.e. correlation) between sales and property growth rates. Interestingly, the measure is also predictive (the crystal ball!); price growth has a tendency to follow (lag for all you statistic/econometric nerds) sales growth by between three and 18 months. Combined with qualitative and cyclical analysis these measures provide a more holistic approach to the research process.

Similar results were obtained when analysing, among other things, interest rates, GSP and private capital infrastructure. In addition, the behaviour of the property market in response to changes in these factors differs depending on economic condition, with a clear delineation between the pre and post GFC period. Clearly, we need to take a vigorous approach when it comes to property market research.