Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

When delving into investing or setting out to secure your first home, everyone wants to find something affordable. This is determined by whether a purchaser can buy or rent a house without unreasonable financial strain. The 13 interest rate hikes have impacted Australians significantly, increasing overall living expenses. In response, people are actively seeking more affordable properties where rental income can cover mortgage repayments.

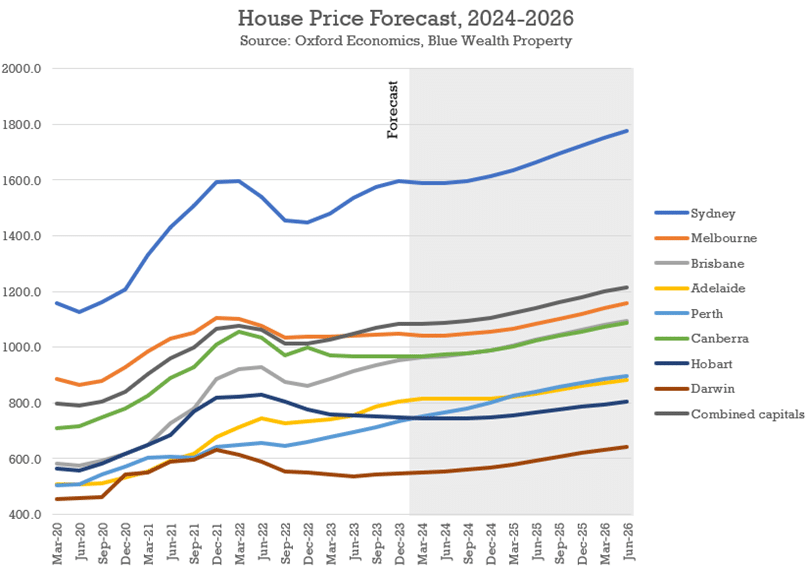

It was clear last year that Perth and Adelaide performed exceptionally well because of higher levels of affordability. Those two cities and Brisbane had the fastest price growth and are expected to remain extremely strong in 2024. Low supply levels and increasing rents will continue to propel these markets during this property cycle.

What is the outlook for 2024?

Oxford Economics projects house prices to increase by 2.7% nationally in 2024, signalling a noticeable deceleration compared to 2023. However, the outlook remains optimistic, with expectations of a robust surge exceeding 6% in 2025 and 2026.

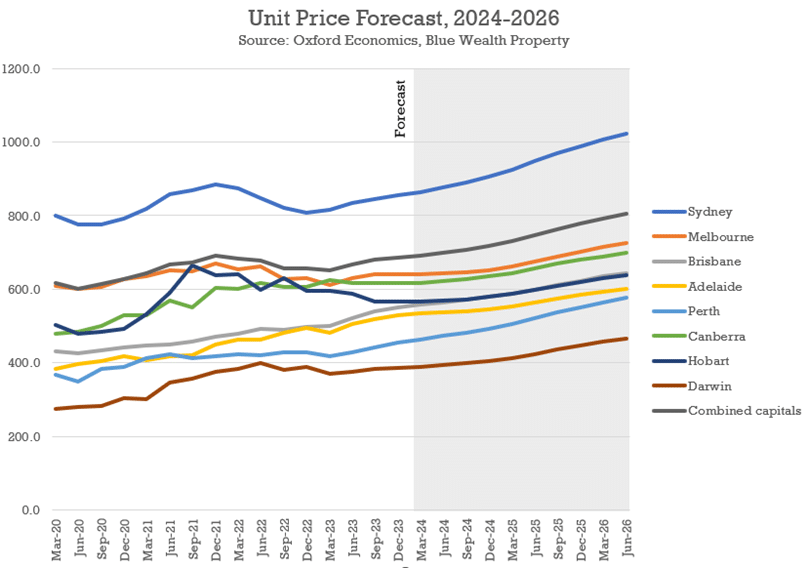

While house price growth may remain subdued nationally in 2024, unit prices are poised to grow at a faster pace of 4.6%. This trend is anticipated to be particularly pronounced in various cities, with units outpacing houses in Sydney (6%), Brisbane (5.1%), Adelaide (3%), and Melbourne (2%). The standout performer is Perth, where unit prices are expected to jump by a substantial 8.5%.

The combination of higher living expenses and reduced borrowing capacities are the reasons why units will grow quicker than houses. With the lower price points, units may be the only option for buyers with less to spend. Nationally, median unit prices are almost $200,000 cheaper than houses, and in Sydney, more than $500,000 cheaper.

In 2024, the trend of purchasing reasonably priced real estate is expected to persist, particularly in the first quarter or two of the year. This trend is primarily driven by economic factors. On a longer-term timeframe, this trend will likely become increasingly common as land prices continue to outstrip wage increases and successive generations find it increasingly difficult to afford houses.