Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

One of the perennial favourites of the mainstream media each cycle is an article about the death of ‘The Great Australian Dream’, and I must admit, I’m a sucker for those articles. I don’t know if I read them just because it’s fear porn or because I’m genuinely afraid for my children’s future. But regardless of the reason, I read them, and now it’s your turn to read one too.

One thing I can’t deny is that it is harder to buy a house on an average income when I look objectively at the metrics. There is a secular trend of house prices requiring a higher and higher income multiple to buy. This is almost entirely because the current monetary system has effectively financialised houses. That is to say that they have become a financial asset rather than just a place to live in because people either consciously or subconsciously recognise that they are a more effective store of wealth than cash in the bank.

My father is a great example of this. A first-generation immigrant with only a high school education, he lived through the Great Famine in China. At the time, there was food rationing where each person was allowed to buy one bowl of rice per day, and 50 million people starved to death. He survived by smoking out field rats from their nests and using a slingshot to hunt birds. Like all immigrant stories at the time, he came to this country looking to provide a better life for his children. Through the late 1970s and 1980s, he made a good living selling fruit at Flemington Markets. An opportunity which he has always held a deep gratitude for.

He would have been comfortably in the country’s top 0.5% of income earners at the time. He spent much of his money on his children’s education and buying property. Being from a generation that lived through a civil war, a world war, and a famine, his primary focus was security rather than taking risks. So, he also saved up a lot of cash in term deposits. Over time, I watched as the purchasing power of his cash savings eroded while his property portfolio grew. Thankfully, he had enough rental income to retire in relative comfort.

Gradually, I came to understand what was happening to his assets, and that same process continues to this day. The only difference is that it appears to be occurring at an accelerated rate, and we are now forced to move further along the risk curve to stay ahead. The property market has entered a perfect storm for both renters and prospective purchasers.

Last year, the population grew by 600,000 people (550,000 from net overseas migration), and this year, immigration is expected to be around 345,000 people – around double the pre-pandemic average. Approximately 75% of the migrant intake ends up in rental housing. Just as construction activity has collapsed due to the nasty combination of spiking materials costs, labour shortages, and the inability of developers to stack projects up. As a result, we’ve seen capital city rents spike an incredible 45% since the start of the pandemic. Over the same period, house prices have increased by 35.5% nationally.

And how much did wages rise? A paltry 10.2%.

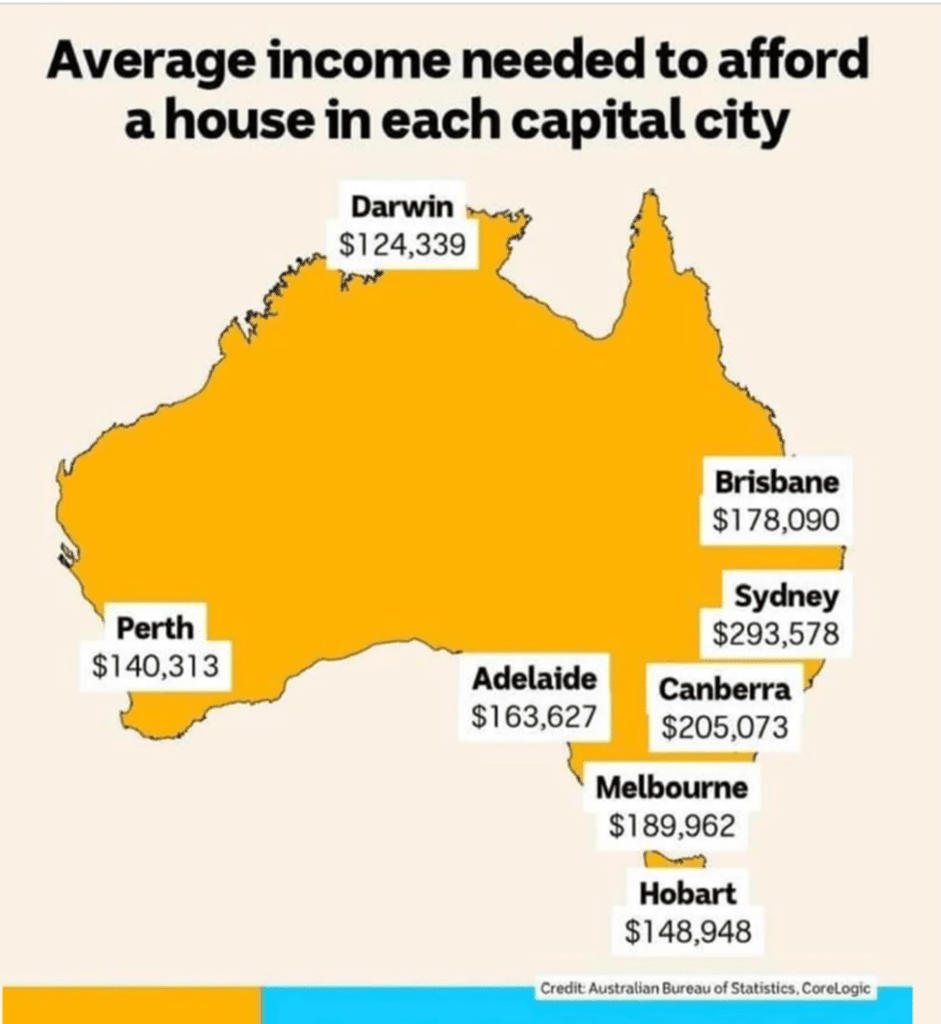

Our CEO, Tony Hayek, shared this infographic with us yesterday.

While it is a somewhat crude analysis, it does highlight some interesting points. The first is there isn’t an easy path to buying an ‘average house’ for most ordinary citizens in Australia. This is particularly so when you consider that you must save up for the deposit and other purchasing costs, such as stamp duty, while house prices continue to accelerate faster than the pace at which most people can save. The second is that there are some clear differences in affordability between different capital cities.

As I have stated in this blog, Perth is the fastest horse in the race this cycle. At the same time, it offers an interesting opportunity in that the median house price is also the lowest among the major capital cities. If I were a first-time investor who had been priced out of the city I live in, the perfect property would be one that is simultaneously at a price I could afford while growing at a faster rate than the city where I want to live. So that by the end of the cycle, I would be closer to my goal than I would be further away.