Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

This is our last blog for this year as we head into a much-needed Christmas break. I can’t believe it’s gone by so quickly! As I write this, it looks like a proper Australian summer, and it feels good to see endless blue skies again after a couple of back-to-back La Nina years filled with heavy rain and muddy backyards. The big kingfish have just turned up on the headlands again, as they do every year around this time, and my fishing mates are sending me videos already. The marlin and mahi won’t be far off either – they’re already showing up in South West Rocks a few hours to the north. Just another reminder that all things in nature and the cosmos run in cycles.

This is always a good time to slow down and reassess what is important. Even though this business is almost solely focused on wealth creation, the reality is most of us are already wealthy. Living in Australia, even on an average income, we’re likely already in the top 1% of the global population when it comes to living standards. Nevertheless, if you’re still here, it’s likely that you want to keep building. True wealth, as far as I’m concerned, is getting control of your time – having the ability to do what you want, when you want. And maybe, more importantly, knowing how to have a good lifestyle and when to stop the goalpost from moving.

In the world of property and finance, it’s been another turbulent year dominated by high inflation, rising interest rates, war, and recession fears. Despite this, the Australian economy ended the year 6.4% larger than when the pandemic struck, and wages have been growing at their fastest rate since 2007. I don’t have much more to say about it that I haven’t already said other than that 2023 is likely to be calmer, with inflation already easing in most developed countries. Global GDP is still expected to rise above 3%, and Australian GDP around 3.5% for the year – quite a remarkable result given everything that’s happened. I will leave you with a couple of charts.

The DXY (USD) index has also hit a long-term resistance level going back to 2009, indicating that the USD is likely to continue to weaken. This allows other countries to ease up with their rate rises as well because they don’t need to defend the strength of their local currencies against the USD.

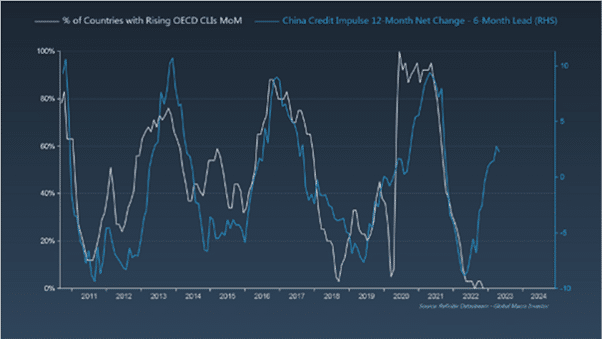

The liquidity conditions are also easing rapidly in China, which usually leads OECD countries by 6 months – a good forward indicator that the second half of 2023 will offer much improved conditions for assets.

Take care over the holiday break; it’s time for me to get some sun, do some fishing, get some exercise in and catch up with some old friends! I wish you all a merry Christmas and a Happy new year.

Yours sincerely,

Gavin Chau