Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

No matter who you are, hard times are a given – you are always going to see some bumps along the road. Property investment isn’t any different. Whether the bumps come from globally driven factors or from the opinions of others, we hear all too often of emerging catastrophes in the current markets. Fresh investors and of course those who have been in the market for decades will all have experienced these alarming stories.

I understand these can be discouraging for many and who can blame you for trying to avoid danger? Unfortunately, what we commonly see is that fear of these bumps can lead to swift and irrational decisions that are ultimately costly in the long run.

So, what did these bumps look like and what have they cost people in the past?

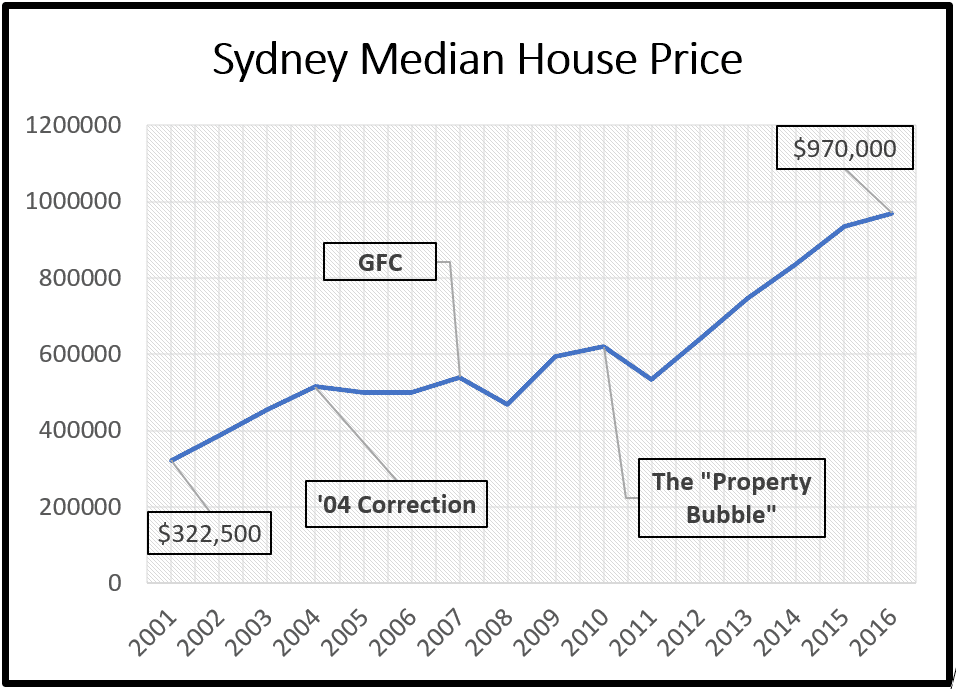

For an historical overview, let’s look at the Sydney market. If you were active in the Harbour City over the last fifteen years you will have heard recurring warnings of the upcoming property market crashes ringing through the airways.

2004 – Market Correction: After a growth phase that eclipsed the most recent one from 2012 to present Sydney property prices didn’t crash but stagnated. They declined by an average of 1.5% per annum between 2004 – 2009.

2008 – Global Financial Crisis (GFC): The Australian population observed America’s greatest financial crisis since the Great Depression, which wiped more than 50% from the ASX 200 in sixteen months (6754 at October 2007 and 3344 at February 2009). What followed? The weighted average dwelling value of Australia’s capital cities declined by only 4%.

2010 – Property Bubble: Interest rates were increased by the Reserve Bank of Australia in the view that the market had corrected post GFC (rates changed from 3% to 4.75% with an increase of 175 basis points from April 2009 to November 2010). What resulted was an initial decrease of 14% in Sydney house prices. Consequently, media outlets blanketed the market with the speculation that the looming property bubble had finally burst and warned of housing prices going into freefall. Sydney has since experienced one of its strongest growth periods in recent history.

(Source: Australian Bureau of Statistics)

According to data presented by the ABS, an investor who sustained a long-term hold of 15 years with an average property in the Sydney market would have achieved a return of over 200% today. However, our results reflect that when price growth is stagnant or dampening, sales volumes decline as property buyer sentiment lowers. When sales volume increases the demand side spurs price growth. For further insight, click here.

This obviously doesn’t account for the many sentimental challenges that investors face day to day on a personal level. These come in many forms: from fear mongering by the media, to legislature changes, personal attitudes and even the opinions of your friend who seems to have the hot tip in the market (but never owns anything themselves).

Just like in life it’s how you take the hard times that really makes a difference. So, will you let those irrational fears control you, or get educated and follow the road to success?