Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

I have no idea what the retirement age will be by the time I reach the twilight of my life. One thing I am quite certain of is that I don’t want it to ever concern me. Currently, the single age pension ‘maximum basic rate’ is $842.80 per fortnight, a little under $22,000 per year.

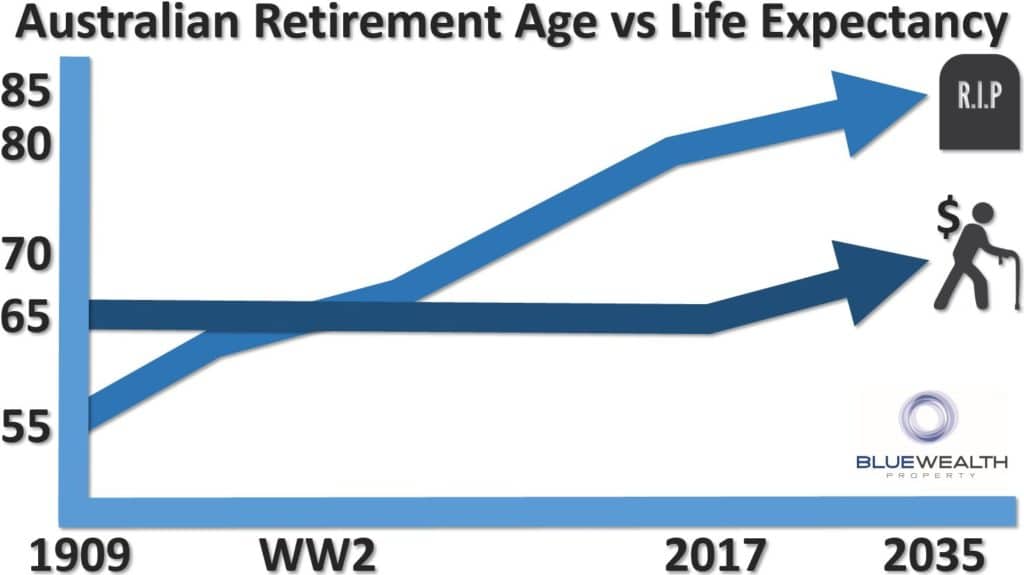

The interesting thing about the aged pension is that it was actually introduced in 1909 in an effort to alleviate poverty among frail elderly Australians who at the time were ten years beyond their life expectancy. Now it is viewed in a far different light.

Over one hundred years after the introduction of the age pension, the only significant change has been asset and income tests, as well as increasing the female eligibility age from 60 to parity with males. The problem with the lack of significant change in the age pension, as the Keating government noted in 1992 with the ‘Super Guarantee’ employer contribution scheme, is that there are now more of us and we are expecting to live longer each year.

A significant chronological point for life expectancy versus retirement age in Australia was the period of World War Two. Over this period, life expectancy intersected retirement age (age pension eligibility) and exceeded it. This is where we observe the pension shifting to an ‘entitlement’.

As the now overworked Baby Boomers entered the workforce in droves, the imbalance between retirement age and life expectancy was offset by the increase in government revenue from their taxes but, as we have heard, what goes up must come down. Now Baby Boomers are beginning to leave the workforce in droves, and the Gen Y’s and Z’s are avoiding work at all costs with their array of tertiary qualifications.

Baby Boomers are taking the brunt of supporting those before them during their working lives and having to support those behind them as they transition to retirement at a progressively later age. As they retire, the 20 years prior of ‘Super Guarantee’ contributions are likely to have not been enough for the majority.

The lesson learned from this is that although living longer is one of the greatest international gauges of the wellbeing of a population, the flipside is that it is increasingly imperative to take positive control of your financial future.