Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Research conducted by associates of Cornell University suggests that as humans we make approximately 35,000 decisions each day. The importance of each ranges widely from what to eat in the morning, right up to life changing decisions such as who to marry and where to live. As a result, effective decision making can be one of the most important skills a person will ever learn.

A mantra that rings throughout Blue Wealth and one that fits the theme of investment well, is that “you should never make a decision based on fear”.

Fear is the death of logic and often acts as a negative motivator. Overcoming fear is a practice that is critical when investing. Your choices around where and what to purchase should be based on knowledge and research rather than emotion.

While this is true, recent changes throughout government have made it clear that the majority of Australian investors base their decision making on fear. Possible changes to legislation coupled with the idea of a leadership shift created a widespread fear of uncertainty throughout our nation over the last 6 months. The consequence of which was a fall in investor demand throughout our capital markets.

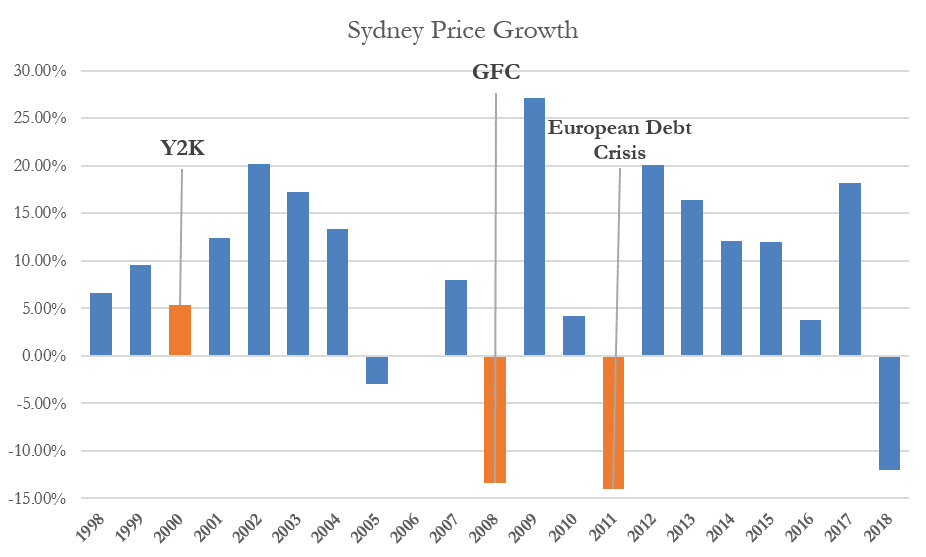

To highlight how irrational fear-based investments can be, I want to take you back through history to some of the mot fearful moments our markets have faced.

Y2K

The year 2000 marked a point in time where the world met a new millennium. Various computer programs were expected to malfunction as we moved forward past the milestone. This reportedly had the potential to crash linked computer programs and take investment markets along with it. The result was shaken investor demand that was felt by markets around the world.

GFC

A mixture of lax lending by financiers, excessive risk taking and poor policy decisions allowed for a collapse in the American housing market throughout 2008. Stresses in the financial system allowed the pain felt in the market to spill overseas to adjacent markets. While this had lesser impact on Australia, falling sentiment was again a major factor that allowed for buyers to abandon their investment dreams due to fear.

European Debt Crisis

Starting at the finish of 2009, this multi-year debt crisis saw several members of the EU unable to rectify government debts. the result of which was major adverse effects throughout labour markets, resulting in fears that the impact could be internationally felt throughout Australia.

While they correlated with the natural market cycles associated with the property market, these events had the capability to impact investor decisions negatively with many opting to even offload established investments.

Basing their investment decision on fear came as a costly exercise for investors at each stage of market correction. The average investor that opted to hold throughout all of these fearful times and did not allow fear to impact decision making will have experienced price growth of approximately 263% ($650,000 rise in median house prices).

The reality is, property investment is a long term game where emotion does not belong. Those who have the ability to rationalise short term fears and follow research, allow themselves the best opportunity to capitalise in our property market. So, next time you make a decision to invest, don’t allow the fears of today ruin the possibilities of tomorrow.