Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

As median house prices soar across the country, young Aussies are watching the ‘Aussie Dream’ slip away (might have something to do with all the smashed ‘avos’ you’re eating). Sound familiar? You’ve probably heard similar comments from every media outlet in the country so we’ll provide our thoughts on this in next week’s blog. Today I want to talk to you about what makes property such a great asset class and how you can use your resources to their best potential.

There are many advantages of investing in property, the key three being:

Stability

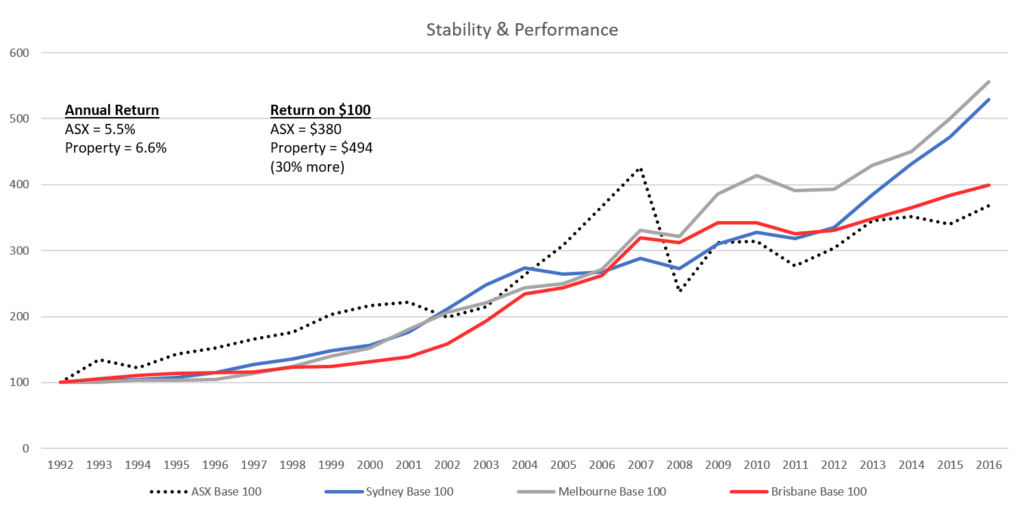

Property is a very stable asset – there hasn’t been a property crash in almost 130 years (since 1889). Australia’s capital city economies are stable, evolving and high performing by global standards, which insulates the property market from volatility and has resulted in steady and consistent price growth for decades. The GFC wiped away more than 50% from the ASX 200 over a sixteen month period, resulting in the greatest financial disaster since the depression. How did property fare over the same period? The weighted average dwelling value of our capital cities declined by only 4%. Not much of a bursting bubble, was it?

Performance

The year is 1992. Assume you invest $100 in the ASX 200, or alternatively in an average house in Sydney, Melbourne or Brisbane. By 2016 that $100 would be worth on average $380 for the ASX 200 and $494 for the property investment. The average annual growth rate for property (Sydney, Melbourne and Brisbane) between 1992 and 2016 was 6.6%. For the ASX 200 that figure was 5.5%. Over twenty-five years property outperformed shares by 30%, and that’s without even diving into leverage.

Leverage

Here’s how leverage works. Let’s say you save $100,000 to invest; you have a couple of options:

1) invest the $100,000 without leverage

2) use the $100,000 as a 20% deposit for a $500,000 property

Leverage allows you to hold a large asset with a relatively small investment, and small growth on a large asset can be better than large growth on a small asset. See below a comparison on how leverage allows you to hold a bigger asset.

William and Jayde are experienced investors who have both saved $100,000.

| William uses his $100,000 to buy an investment property worth $500,000 so he now has $500,000 in assets | Jayde invests her $100,000 in the share market, so she now has $100,000 in assets |

| If the property market increases at 6.6% per year for the next ten years, his property would be worth $947,000 | If the share market increased at 5.5% per year for the next ten years, her shares would be worth $171,000 |

| $947,000

-$400,000 in debt -$50,000 in costs = $497,000 | |

| William has converted $100,000 to $497,000, which is a 397% return on his original investment | Jayde has converted $100,000 to $171,000, which is a 71% return on her original investment |

William has been able to leverage his money into a bigger asset base, resulting in a far bigger return on investment.

Picking up what I’m putting down?

Recognising the potential in the property market and getting educated is the first step toward making strategic decisions. Understanding the concepts of stability, performance and leverage will help you to create wealth. Your job is to get educated and take action.