Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

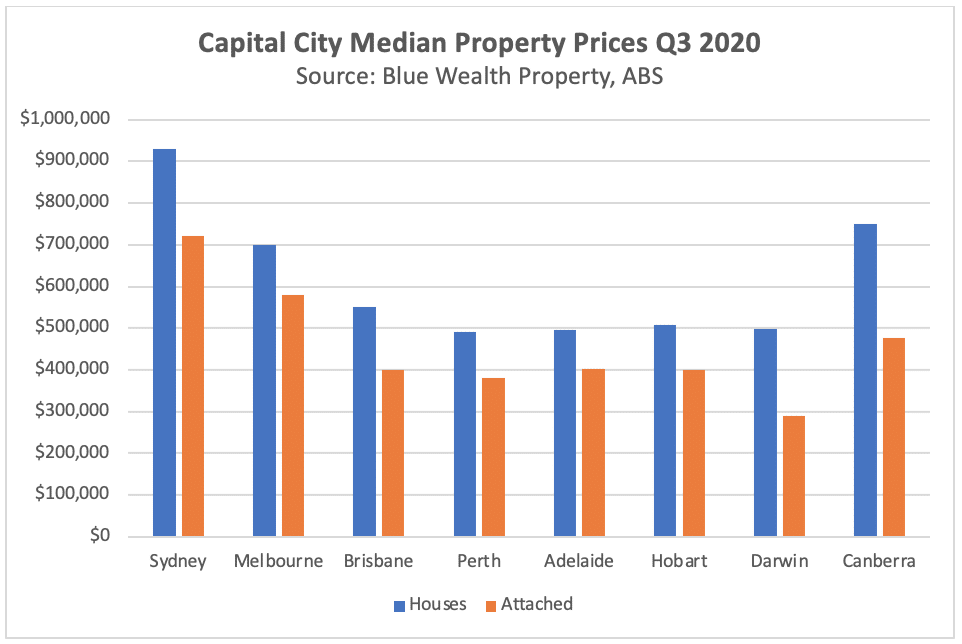

Last week, the Australian Bureau of Statistics released their heavily anticipated Residential Property Price Index for Q3 2020, showing growth in median prices for most cities and regional markets. Why was Q3 of so much interest? Aside from Melbourne, Q3 is when most of the country shifted the coronavirus pandemic to their rear-view mirror. Accumulatively, the growth in housing values represents approximately $90 billion of additional equity in the residential property market. The total value of dwelling stock is now at a record high $7.28 trillion. In addition, the average Australian home is worth 4.5 percent more than it was 12 months ago.

Adelaide, Brisbane and Perth were Australia’s best capital city performers for quarter-on-quarter performance in September. They recorded 1.6, 1.5 and 1.4 percent quarterly growth respectively. For obvious reasons, Melbourne was alone when it came to declines, recording -0.3 percent quarterly growth. In the attached dwelling market, Brisbane and Perth outperformed the other capitals, heralding the positive 2021-23 forecasts made of these two cities by many economists toward the latter part of 2020.