Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

In late November 2017 Sydney’s median dwelling value shifted to $904,041 according to research conducted by CoreLogic, making it the most expensive city in Australia for the tenth consecutive year.

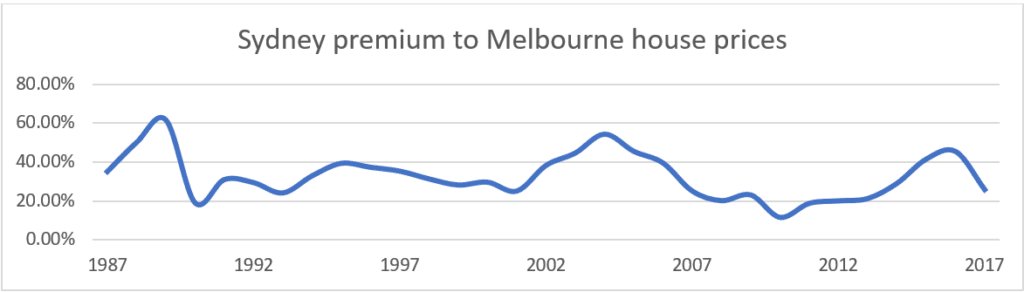

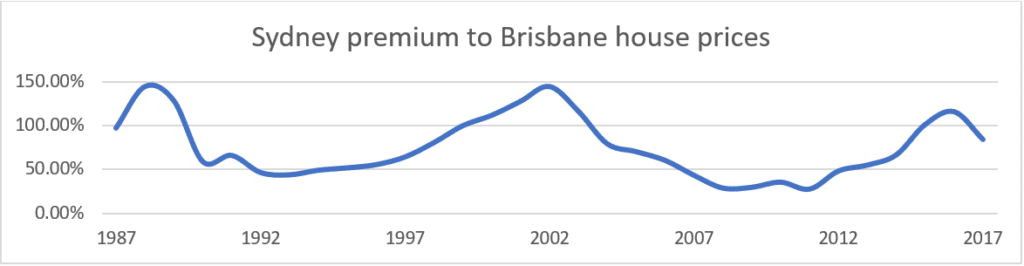

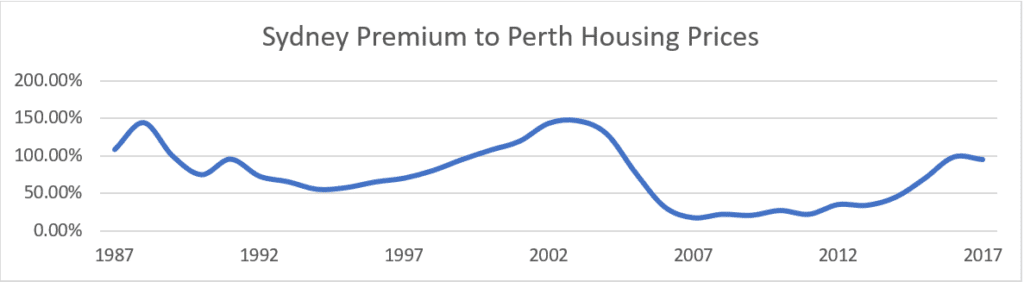

Over the years, the harbour city has consistently held the title of Australia’s most expensive city. Fluctuations in the extent of Sydney’s premium (its superiority) over our other capital cities can be viewed on a thirty-year timeline. When we take a long-term view we can see that Sydney’s premium moves in a cycle, similar to property markets themselves. As the premium reaches it peaks, parity is often restored by improvements in alternate markets. Sydney’s median price rarely ever falls below that of Melbourne, Brisbane or Perth, the only solid competitors over the last three decades.

Figure 1: Melbourne’s dwelling median currently sits at $718,325. Sydney’s prices are currently 25.9% higher.

Figure 2: Brisbane’s dwelling median currently sits at $490,915. Sydney prices are currently 84.2% higher.

Figure 3: Perth’s dwelling median currently sits at $460,026. Sydney Dwelling Prices are currently 95.2% higher.

The current premium of Sydney’s median is above average long-term trends in all our major capital cities excluding Melbourne. Although currently peaking, this doesn’t guarantee a future drop in the value premium. However, the current state of Sydney’s market when compared to the rest of the nation looks reminiscent to the state of the market in 2004. But what can this tell us?

The Sydney market has experienced its first back-to-back quarters of decline in the last seven years, and previously dormant markets are experiencing strong levels of population growth and infrastructure spending. This indicates room for growth in the alternate capitals as the premium corrects itself, particularly those with the largest capacity to employ and educate future residents. In contrast, for Sydney the coming years depict a period of stagnation that may lessen the market’s contentious levels of housing affordability.