Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Data from various sources indicates that inner-Brisbane suburbs are showing stronger signs of performance into 2020. Australia’s third-largest city experienced a high level of anticipated demand for new housing as major infrastructure projects drove investment in the area. Some parts of Brisbane, particularly inner-city apartment markets, experienced a period of market volatility as a spike in residential property supply influenced sensationalist commentary and bizarre forecasts. This further fuelled irrational investor activity such as premature resales.

What did eventuate was a slowing of new development finance which, combined with restrictions applied to foreign and domestic investors, reduced the number of brand-new property sales. As Brisbane’s population growth continued to surge through 2019, the discontinuation of supply was met with a plummeting of rental vacancy rates. Citywide, Brisbane’s vacancy rate peaked in late-2016 which was consistent with a higher lead-up of residential property development. By late-2019, the seasonally high vacancy rate experienced around Christmas was below equilibrium. In fact, equilibrium wasn’t exceeded for the entire year.

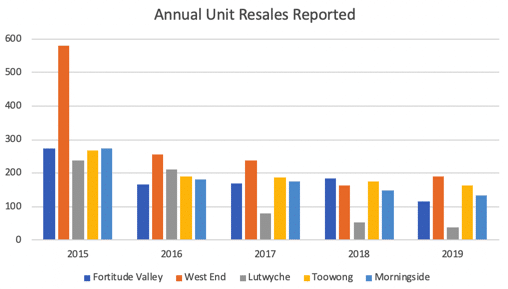

Peak-to-peak summertime vacancies in markets such as Toowong, West End, Norman Park and Fortitude Valley are all considerably lower than recent years, and troughs at other periods through the year are also falling more each year. Meanwhile, the median unit price in many suburbs has been strengthening, suggesting that buyers are active at a higher price point than previous years. The number of resales in many of these markets has also been falling over recent years, which is a positive sign in the context of longer-term holding. It also means less competition for those who are selling.

Source: Blue Wealth Property, REA

Some Brisbane landlords may have found weaker performance in their assets over the recent supply upswing, but now that the market has largely returned to equilibrium and undersupply, they are in a much more favourable position. This is a fundamental of the property market cycle, which delivers various positives and negatives for different parties during different stages. This prolonged buyers’ market in Brisbane enabled many property investors to acquire an asset with a strong price-to-income ratio and an even stronger long-term market outlook. For those who sold at this time, the negative would have been competing with other vendors in a busy market before benefits of population growth and infrastructure investment were fulfilled.