Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

A few weeks ago, we discussed the case of a property investor in Brisbane who grew frustrated by a two-year period of weak performance in his asset and sold it for a loss—only for this positively geared asset to grow in value by 10 percent over the following 15 months. There are many cases of this around the country, with CoreLogic reporting 10.1 percent of properties being sold at a loss in Q4 2020. Data shows those most at risk are investors who only hold their asset for a short-term period (less than four years).

Well, 15 months have now passed since I sold an investment property I had held for eight years. My intention was to hold it for much longer, so what prompted me to sell early and what has happened since?

First of all, I reluctantly decided to sell my property to fund graduate studies overseas. The opportunity to study at this institution is a rare privilege, and one I was very much looking forward to. Since then, I have also been appointed to an academic role with the institution which has allowed me to expand my experience in international real estate research. Nevertheless, this has come at a significant opportunity cost. Making matters more difficult was that as a property economist, I sensed a coming boom. At the time, I was writing about the triple treat of 2020: lower interest rates, loosening regulations and a federal election upset.

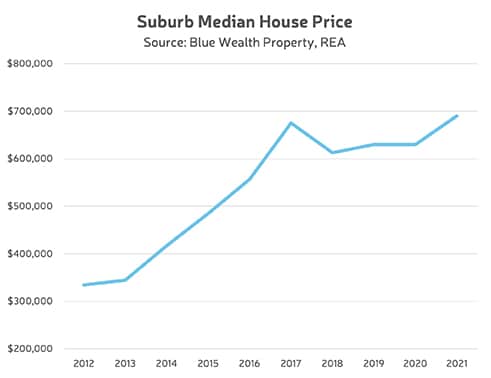

When I listed my investment property with a local agent, the suburb had endured a two-to-three-year stagnation. I sold my property for enough profit to fund a portion of my studies, but considerably less than I would have made a couple of years earlier. Alas, since my sale in February 2020, the property’s estimate value has increased by about $180,000. That’s about $400 per day, every day, for the new owner.

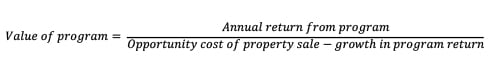

In my case, however, I have no regrets. If I include the cost of my program, the six-figure loss of income from undertaking it, and the missed capital growth from selling early, we’re talking close to half a million dollars. If I assume a six percent opportunity cost from equity growth and three percent annual growth in program return from my studies, my investment in further education needs to deliver at least $15,000 in value annually (either through higher income or quality of life) from next year. Is that the case? Optimistically, I believe so.

The reason I share this story is to emphasise a helpful decision-making process for property investors contemplating a resale. You can substitute education for any other conventional or unconventional investment. You could buy a new investment property or other asset (preferably refinance instead of selling if circumstances permit), take time off for personal growth, finance your new business or an infinite number of other choices. Hopefully, you’d only sell for a handsome profit and if so, the reinvestment you’re making is for a superior return.

However things play out, when you decide to sell your investment property you have to be psychologically prepared to miss the opportunity for hundreds of thousands of dollars of future equity in that asset… so make sure you spend wisely!