Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Our Property Showcase has long been the perfect way to experience all the best things about Blue Wealth: we release the very best of our recommended properties and give you exclusive pre-market access, we update you on the Australian property market, we even give away goodies at the end of the night – you’re probably kicking yourself if you missed our latest showcase last week!

This time around we updated our format to address some of the questions we often get, so let me take this opportunity to give you a quick summary.

Property Bubble

The property bubble has supposedly been on the brink of bursting for as long as I can remember, with headlines like the following being recycled year after year:

We probably should stop calling it a bubble. The image of the bubble implies it is on the brink of bursting at any moment, when all we’ve ever had is a short period of deflation after a boom. The sheer number of different economic catastrophes that would need to take place in unison to pop this bubble is very unlikely to ever happen in the Australian property market. There would have to be drastically higher interest rates, significant job losses and an evaporation of demand, in fact a complete economic meltdown.

Completion Risk

Completion risk refers to the ability of a property developer to deliver the project. Let’s look at local Melbourne developer Steller, who were responsible for the Melbourne property offering in our last two showcases. They have already completed 25 projects in the past five years, with another 17 under construction. They have already started construction on the project we released last week, and it’s also entirely self-funded. Coupled with the alignment of their model with Blue Wealth’s, this track record means their project delivery process is quick and efficient, mitigating risk and minimising holding costs.

Oversupply

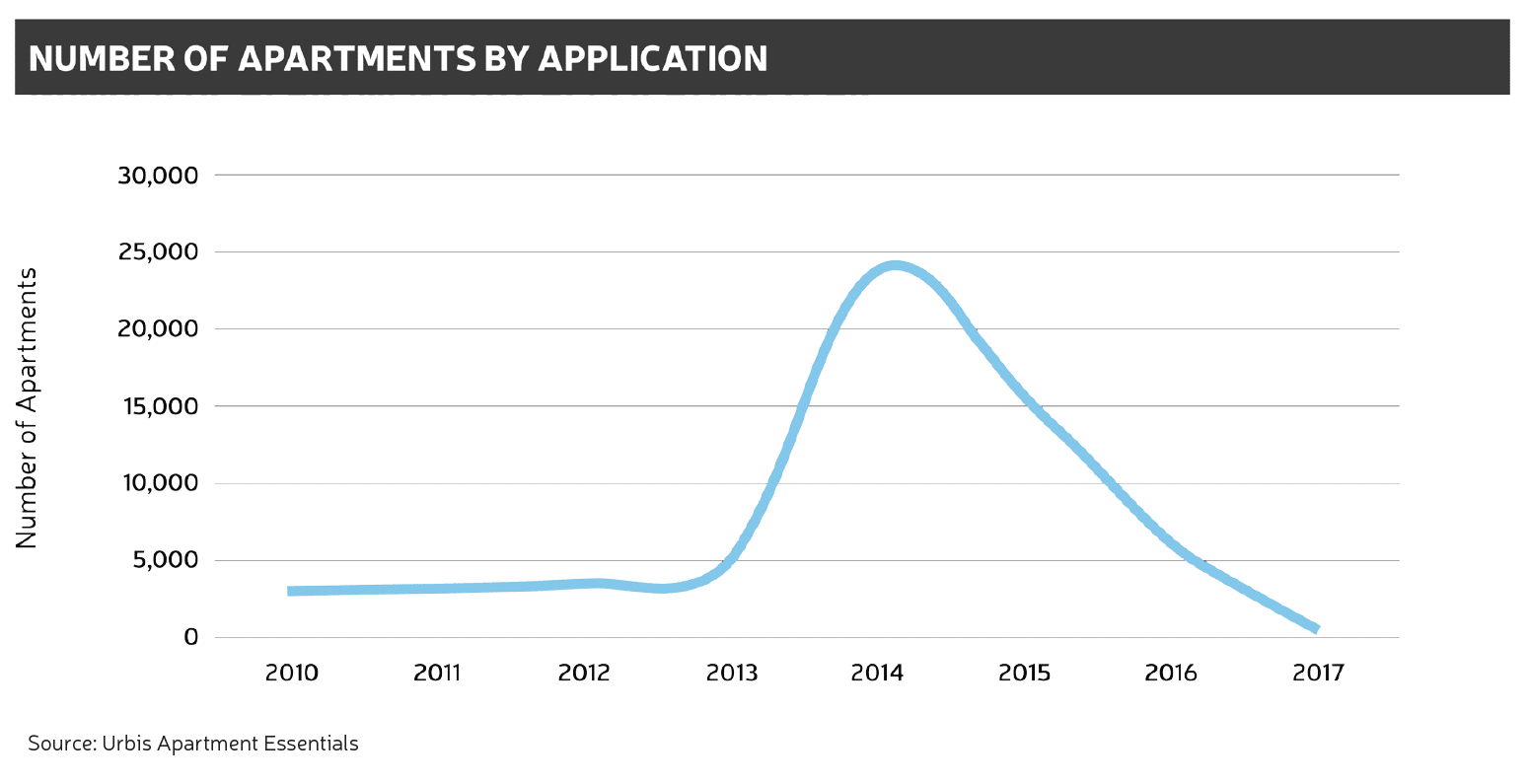

Lately you can’t seem to talk about property markets without talking about oversupply, and of course you can’t discuss supply without demand – case in point Brisbane. The fact is that Brisbane supply is about to take a big hit, with a recent Urbis Report revealing the number of applications has already dropped (Figure 1), and settlements are set to follow in the upcoming years, all due to rising construction costs. As for demand, Brisbane has the highest rate of internal migration of any capital city – people are flocking to the city and supply is shrinking.

Affordability

Many people seem to think the current property market boom in Sydney is the biggest of their lifetime. Unless you’re a 15 year old property investor, the fact is it’s not even the second or third biggest. With after-tax holding costs per week being significantly less than they were almost 10 years ago, it turns out property isn’t as unaffordable as you might think in the current market.

There are always reasons not to do something, and inaction can be a lot easier than the courage and persistence it takes to stick to your guns when there is a lot of fear being spread. I’ll leave you with this final thought:

‘Action changes attitude faster than attitude changes action.’ – Adam Ferrier