Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

I can’t count the number of times I’ve been asked, ‘What makes a property market grow?’ Unfortunately, the answer isn’t so simple as there are numerous contributing variables. Certain markets rely on specific drivers to buoy or grow property prices. There is, however, one underlying answer: simply put, property price growth is a function of supply and demand. When the pendulum swings in favour of demand we tend to see growth in property prices. Alternatively, when we see markets experience excess supply, growth typically remains subdued.

In the past, population growth and migration have been key drivers for strong periods of property growth. Below are a few key examples of this.

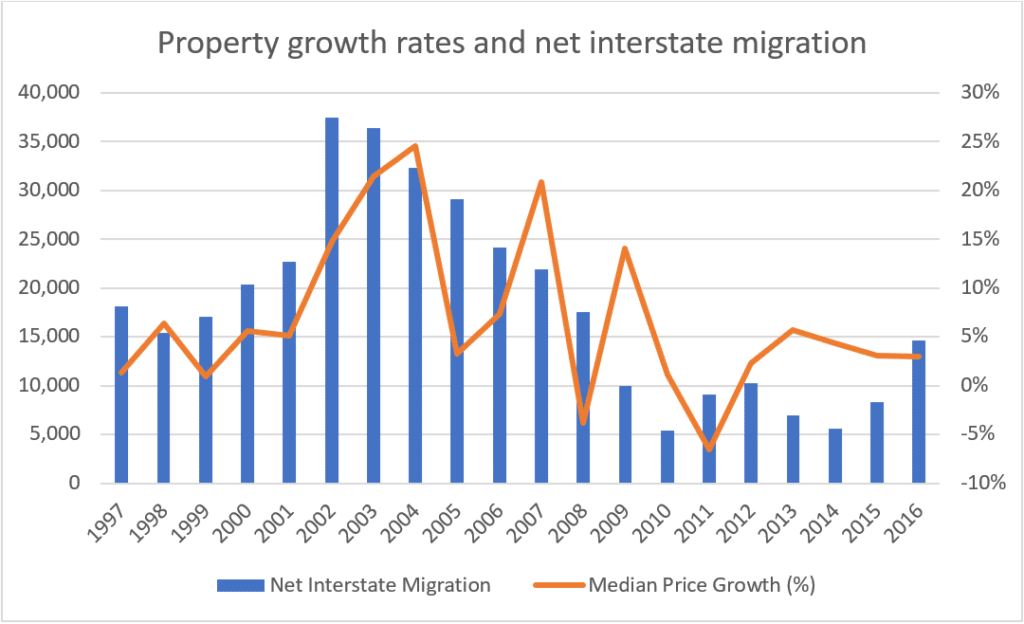

Queensland’s interstate migration 2002 – 2004

Between 2002 and 2004 there was a significant rise in interstate migration that spurred three consecutive years of median price growth, each year seeing growth of more than 20%. With net interstate migration figures again on the rise we are likely to begin to see more positive movement in the Brisbane property market.

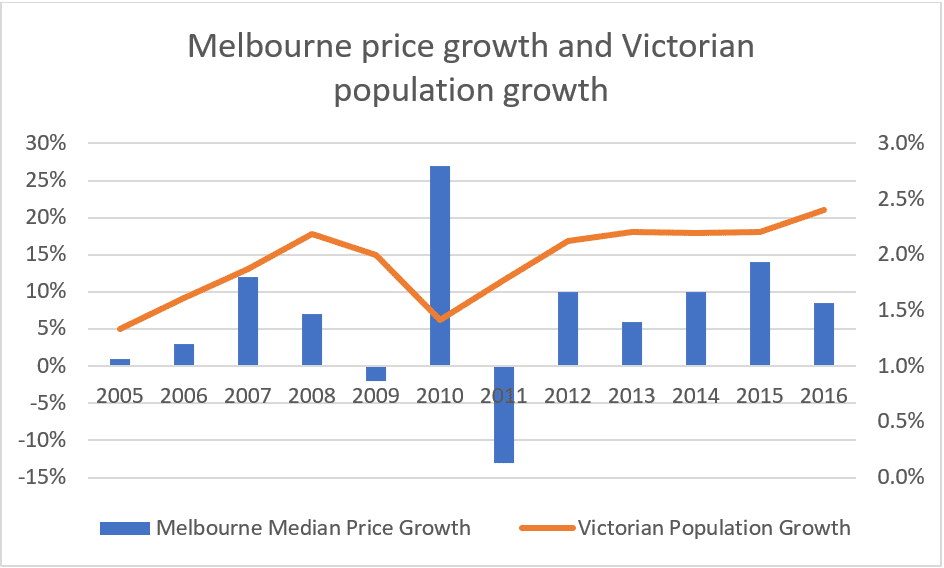

Victoria’s population growth 2011 – 2016

Between 2011 and 2016 Victoria experienced a population boom. According to ABS population statistics, the three years to December 2016 saw over 100,000 new residents per year. The average Australian population growth rate is 1.57%, but Victoria has exceeded this figure every year since 2011. Between 2012 and 2016 an average of 9.7% growth was achieved on Melbourne median house prices.

Similar trends have occurred in Sydney and Perth also, particularly throughout Western Australia’s peak mining periods. Highlighting markets where demand is likely to increase is the most important part of the research process. Of course, a rise in population growth is generally a result of growing employment and infrastructure investment.

So where to next?

Interstate migration figures continue to rise in Brisbane, hinting at positive property performance in the medium term. Victorian population growth rates remain well above the Australian average, which points towards continued buoyant performance in the property market.