Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Australia’s economic landscape is one that is continually changing as we shift further into the twenty-first century. Previously our economic roots were manufacturing and resources but recently there has been an emergence in the services sectors, with the financial centres dominating Australia’s gross domestic product. The continuing transformation of our economy obviously have flow on effects to the performance of our property markets.

For this reason, economics and employment make up one of four key criteria when assessing macro markets. Ultimately population growth raises the demand for properties, and higher levels of demand customarily equate to price growth. And what is one of the largest drivers for the initial population growth?

Jobs!

The migration of people towards major employment hubs is a common trend throughout Australia’s vast demography, so when investing this is a critical element that should be assessed in your property’s macro market. However, many investors have been stung in the past by solely using employment growth as an indicator of a strong market. I argue that it’s not the general amount of jobs added that you should focus on, but the type of employment it represents.

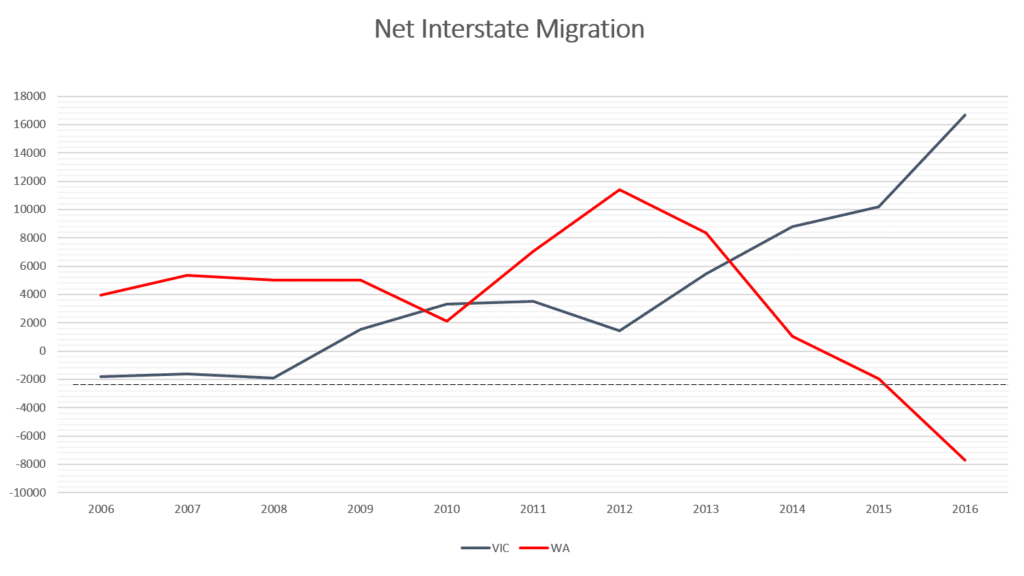

Net Interstate Migration (Source: ABS 3412.0)

Net interstate migration is the net gain (or loss) of population through the movement of people. This represents the real number of residents that are gained in an economy.

Above is the net interstate migration of two drastically different macro markets. For many years Western Australia (depicted in red) enjoyed very solid economic growth as it leveraged heavily off the mining boom and commodities markets. Victoria (blue), on the other hand, reacted to our focus on the services sector by developing Melbourne into one of the largest financial centres in the Asia Pacific region. As you can see, migration to each varied greatly. Why?

Unless you haven’t heard, Western Australia’s mining boom has recently slowed to a grinding halt and over-exposure in the manufacturing and mining industries led to large portions of the population looking interstate for a means of income. The structural economic shift affected the property market as a flow on effect – demand for dwellings dwindled in many regions once driven by the upswing of employment growth.

Alternatively, Victoria emerged as a market with a balanced spread of industries. That is, the major hubs displayed employment opportunities that weren’t focused in just one sector. The result? Melbourne now has the highest rates of interstate migration in the country and a much higher demand for property.

What you should understand is that price growth is a function of supply and demand, but not all demand is sustainable.