Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

For us Melbournians, the past 17 months have played out like an amalgamation of the movie Contagion and Groundhog Day, but in a mini-series. A mini-series that really should have ended at season two, but for many opinionated reasons that I can’t share in under five minutes, continued to season four.

Although season four has left most of the Melbourne population angry, bitter, and twisted, it’s highlighted some incredible results that our clients have achieved compared to most other investors in Melbourne.

If you’re not quite sure what I’m talking about or managed to erase the past 18 months from your memory, here’s a quick recap of what took place as Melbourne’s vacancy rate climbed:

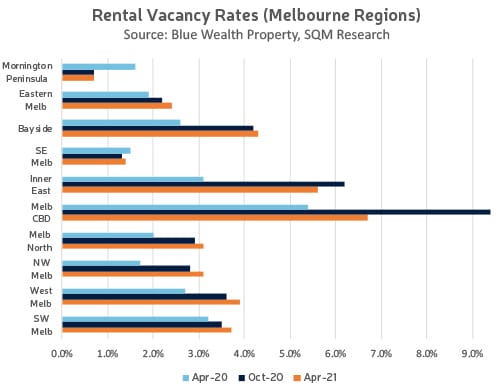

The latest data shows Greater Melbourne’s vacancy rate is at 4%. That’s almost a percentage point lower than it was in December 2020 when it peaked at 4.7%. Whilst Inner City Melbourne still sits at a high of 6.7%, this too has decreased significantly from its Covid peak of 9.4%! See, not everyone has packed up the car for a tree change or moved to the Sunshine Coast! Tenants are out there. For them, this is the perfect opportunity to shop aisle by aisle, picking and choosing the best rental property on the market.

Here’s the thing, anybody with an internet connection can jump onto REA and find an investment property to buy. Most of the listings look fantastic. Professional photos, incredible lighting, furniture staging, charming language… looks great and it’s meant to. They want you to buy it.

But here’s where we come in. Investing in property isn’t a click-and-add-to-cart decision. Hours and hours of research, experience and intelligence is put into every single project that we approve for our clients to buy. Why? Because we want our clients to buy the best property in the right location for the long term.

Whilst most property managers across Melbourne are battling with the highest vacancy levels they have ever seen; I can honestly tell you that 95% of our clients not only have secured tenants but would not have experienced a vacancy longer than 25 days. Why? Because whilst most investors are looking at pretty brochures, our clients are attending our market updates. For them, it’s about getting educated based on actual research that’s going to help them long term.

The biggest driver for the rental results our clients have achieved during this (S&%t-show) pandemic is purely based on one thing. Rentability! Location, size, floorplan, aspect, amenity, accessibility, lifestyle, infrastructure are all the things that make up the rentability of a property and ultimately your point of difference compared to the property in the pretty brochure.

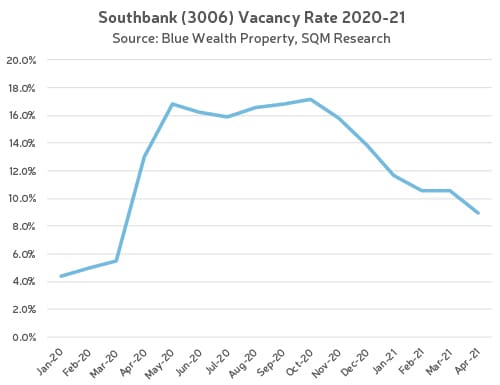

Let’s look at Gravity Tower as an example. A project we sold and settled in Q3 2017. Located in South Melbourne and a street away from its neighbouring suburb of Southbank which experienced one of the highest vacancy rates and competitive markets in Melbourne.

During the peak of the pandemic, 50% of our clients had their tenants vacate (most likely due to the reasons listed at the beginning of this article). The average vacancy period these clients experienced was 17 days. The average rent reduction was 8.6%

Compared to Southbank…

The average vacancy period was more than 90 days. The average reduction in rent was 40%.

The simple facts are that almost every rental property across Melbourne has experienced a rent shift. No amount of research done by any research analyst (Oxford University – quadruple degree or not) could have predicted this pandemic. But owning an investment property backed by proper research has most certainly protected our clients in this crazy environment.

In our world, our research has led us to Melbourne for a reason and as we come out of our fourth lockdown and pray that this mini-series is axed, I am beyond confident that we will soon remember why this incredible city was, is, and will again be, the most liveable city in the world.