Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Investment property and immigration are two sides of the same Australian coin. This ever-increasing population needs somewhere to live! The Australian economy and taxation system are engineered to reward investors for accepting the risk and responsibility of providing this housing.

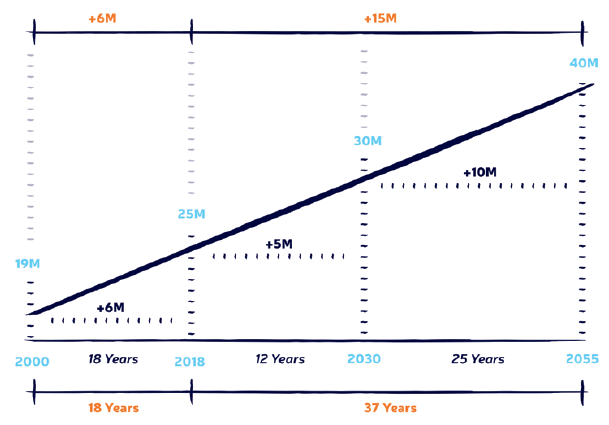

If we dial back the clock to 2000 Australia’s population sat at 19 million. Fast forward to today and our population sits at 25 million, an increase of 6 million in eighteen years. Based on conservative government projections the population is expected to reach 30 million by 2030. That is a further increase of 5 million people in the next twelve years.

Based on the government’s 2015 Intergenerational Report, Australia’s population is projected to reach 40 million by 2055, an addition of 15 million people over the next thirty-seven years.

78% of the Australian population lives in New South Wales, Victoria and Queensland, and 88% of the net immigration in 2017 moved to New South Wales, Victoria and Queensland.

Australia not only has one of the fastest growing populations in the developed world, but it has one of the most geographically concentrated populations.

Understanding these numbers and their long-term secular trends is the beginning of understanding our country’s need for well-located residential investment property that can house this expanding (yet highly concentrated) population.

All that being considered, it is essential to identify and invest in the right quality assets that are going to take advantage of this future growth. Within this growth different markets will perform in different cycles and timelines, and so identifying the right market and the right property and investing at the right time becomes paramount.