Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Over the last few weeks, there has been a flurry of commentary on the impact of lower auction clearance rates, highly motivated vendors trying to “get out” before greater restrictions are enforced, as well as a number of vendors doing the opposite: withdrawing their listings until things go back to something that resembles normal. In this week’s research blog, we are going to look at what happens in a property market when sales volumes decrease.

Sales volumes are an interesting trend to follow, but they can be a risky trend to run commentary on. Generally speaking, higher sales volumes occur when market sentiment is high. They are usually accompanied by booms because higher sales volumes mean:

The above precipitates an important distinction between high sales volumes (a successfully completed sale) and high listings volumes (which without a successful sale, could just mean oversupply). When analysing a high level of activity in a market, we must ask ourselves which one of these two is occurring. This is a large part of why supply and demand are integrated into our research model.

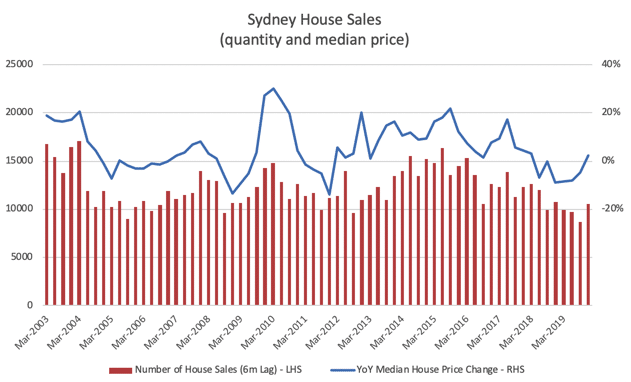

Over the last two decades in Sydney, we have been able to observe a strong relationship between median house price changes and respective sales volumes. Typically, a spike in the number of house sales is followed six months later by a spike in the median house price growth rate (see the below graph). It is important to note that other factors are likely at play (also known as confounding variables). Examples include the availability of finance, population growth, market sentiment, etc. This is the first time, in a very long time, that an “artificial” market force such as the COVID-19 lockdown is playing a notable part. By artificial, I mean that it is not a crisis caused by the financial system itself (like the 2008 GFC and 2015-19 APRA credit tightening were).

Source: Blue Wealth Property, Australian Bureau of Statistics

Fortunately, in the case of Sydney and many other markets, we are coming from the cooler market of 2017-19. The persistently low sales volumes recorded over that time resulted in correction and stagnation for Sydney, a milder correction and upturn in many parts of Melbourne, and an even milder correction or steady market for many parts of Brisbane.

So, what does this mean for property investors?

It is likely that we will be finding pockets of strong opportunity in markets that had until recently been rejected by our model. The shockwave currently surging through Australia’s economy has certainly become a large burden for many of us, but these circumstances almost always offer the most promising opportunities. As we have discussed recently, some such factors include:

In essence, while we wait out COVID-19 we will continue to sit through a buyer’s market. This means it isn’t a great time for current property investors to sell but it could be a great time to buy. Bolder investors will have the opportunity to purchase while things are quieter and less certain, offering a greater potential for upside when things return to normal. Risk-averse investors are more likely to wait for surer signs, but since data on the upswing will be delayed by several months, their upside may not be as significant.