Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

There are certain things that are supposed to terrify us, things that go bump in the night, vampires in castles, or even clowns hiding in stormwater drains. But Lenders Mortgage Insurance (LMI) is as lovely as a basket of kittens and quite possibly the best invention since we started slicing up bread.

Don’t let any of the Dr. Google loonies tell you otherwise.

Banks, Building Societies and Credit Unions are all mortgage lenders. None of them particularly care about the property. What they care about is minimising the risk on the funds they lend out. Residential property has traditionally been one of the lowest risk assets.

Why do we need it?

Lenders Mortgage Insurance was introduced into Australia in 1965 under the simple premise to help first home buyers get into the market earlier. Today is no different.

Believe it or not, there’s never been a point in Australian history when we have given away property to passersby. It’s always been a bit of a sacrifice to save enough money for a housing deposit.

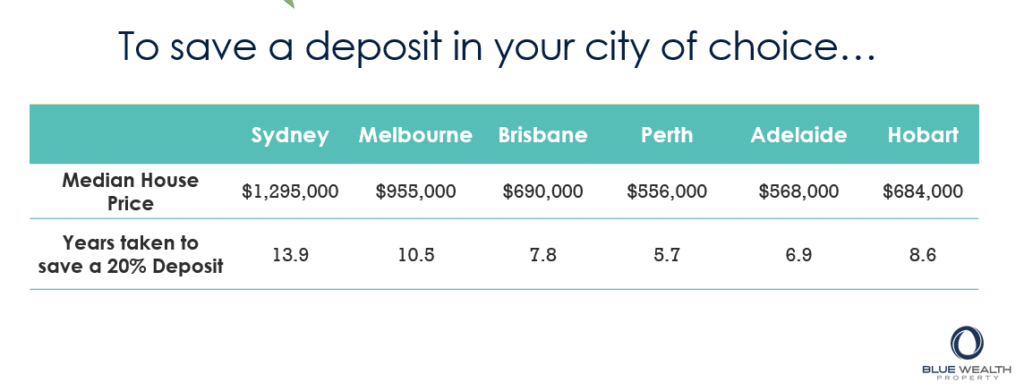

Back in the 60s petrol might well have only been 8c per litre but the struggle to save a 20% deposit was just as real and an impediment to achieving the dream of homeownership. See the attached graph on the average time to save a 20% deposit in your city.

The turning point came in the mid-1960s when some bright spark invented Lenders Mortgage Insurance. The purpose was to help Aussies get into the property market sooner. The motivation for doing this was clear enough. The more property that was sold, the more mortgages were written and the more money the banks made. Simple business economics.

In 1996 the Sydney median property was $160,000 and the average wage was $40,164.

Since then, we have traveled through very interesting times in the property finance world because the Australian house price growth has well and truly outstripped wages.

Part of the reason for this widening gap has been falling mortgage interest rates, the rise of dual-income households as part of the women’s liberation movement, and the practical change from 20 to 30-year home loans – which have aided affordability.

However, during the entire period, homeownership has remained relatively stable hovering around 68% to 70%.

The general media has periodically run its tried-and-true method of using fear to sell headlines. The mere mention of ‘doom and gloom’ around property sells stories quicker than Cathy Freeman could snag a gold medal. They dangle clickbait headlines “home buyers priced out of markets”, “prices set to skyrocket”, “housing hotspot explodes”, and “first-time buyer forced to sell a kidney”. Despite this, we see the median house price in Sydney has climbed up over $1.3 million. The median home loan is now around $620,000.

The gripe that many ill-informed Australians have about LMI is typical “it’s a rip-off, you’re paying the insurance for the bank, it is not protecting you (the buyer)”.

Let’s break down this most popular whinge

Yes, LMI is there to protect a lender’s financial position in the unfortunate event of a borrower defaults on a residential mortgage loan.

If the security asset (home or investment) is required to be sold because of default and the proceeds from the sale do not cover the outstanding loan balance and any of the legal costs incurred as part of the process, the LMI company will cover the lender’s loss.

When we have a happy lender, we have better deals for all of us.

One often forgotten cost is the ‘opportunity cost’ of not entering an appreciating market at the earliest possible opportunity. The benefits far out way any disadvantage that you can think of.

Get an amazing mortgage broker who will work you through your own numbers, so you can take the first step to buy your own investment property. There may never be a better time than now.