Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

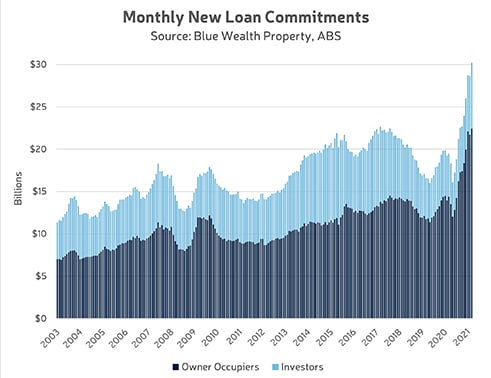

Over the past 6-12 months, most talk about the post-pandemic property boom has centred around owner occupiers. This is for good reason. Between May 2020 and March 2021, monthly lending to owner occupiers nearly doubled from $12 billion to $22.4 billion. Of those amounts, $3.7 billion in May 2020 was from first home buyers, which reached $6.8 billion by March 2021. The silent achiever over this time, however, was the resurgent investor market. Between February and March 2021, monthly new loan commitments for investors grew more than any other month-on-month period since records began two decades ago. On a percentage basis, the last time month-on-month growth was this high was in July 2003.

Property investors are now borrowing nearly twice as much each month as they were in May 2020 and have finally returned to levels last seen in 2017 (the last boom). Combined with record-high owner occupier borrowing, the mortgage market is busier than it has ever been. It doesn’t take a genius to surmise that more price movement is on its way, but let’s see how it has played out historically.

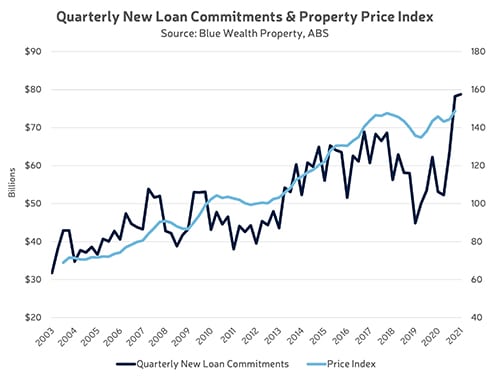

As you might be able to see in the above chart, the residential property price index tends to reach peaks or troughs a quarter after quarterly new loan commitments do. Through the magic of multiple regression analysis, this allows us to estimate the price index one quarter ahead of time (also incorporating the impact of lending in recent quarters). According to this method, the ABS residential property price index for Q1 2021 should be between 154 and 178 (or more specifically, approximately 166). At these levels, you could expect the ABS to report Sydney’s Q1 2021 median house price somewhere between $1,035,600 and $1,197,041. We’ll find out for sure on 15 June 2021 in the next release of the ABS residential property price index.

Combined with the reluctance of regulators and lenders to intervene in the growth of borrowing, our analysis suggests that we should continue to see record increases to Australian home prices in the short term. This is problematic for people in the market who are dragging their feet. It’s very much the case right now that delaying the decision to enter the market could eat away at some of the growth you might have been able to access if you had made your move sooner.