Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

With the first quarter of 2021 behind us, CoreLogic have released the March 2021 results of their capital city home value index. All Australian capitals experienced price index increases over the month for both houses and units, indicating that many Australian property investors are better off now than they were a month ago. In some areas, the growth experienced over the month of March 2021 would usually be considered a decent amount for a year. Hobart units, for instance, grew 4.9 percent over the month, while Sydney houses grew by 4.32 percent.

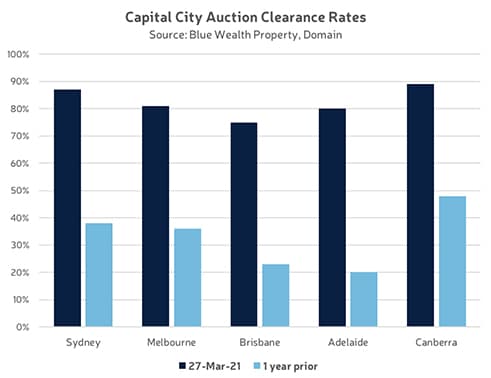

Auction performance in Australian capitals reported by Domain stands in stark contrast to the same time last year. On the last weekend of March, Brisbane’s auction clearance rate was 75 percent (as opposed to 23 percent the same time last year). Melbourne reported an 81 percent auction clearance rate (as opposed to 36 percent the same time last year). Sydney, Adelaide and Canberra all followed a similar trend.

The performance of Australian property in the first quarter of 2021 reinforces our forecasts last year that we would see record market interest and buyer activity. Now that mania has well and truly entered the market, however, investors should continue to keep one eye on the horizon. These low-effort times won’t last forever, so you should be considering what type of investment stands to continue serving you long after this stage of the market cycle is behind us. This means keeping our research model at top of mind: integrating both growth and cash flow.

Although many investors are currently enjoying both positive cash flow and capital growth, you should consider whether assets you’re assessing can manage to stay that way, or at least remain compatible with your personal circumstances. Properties with low rental yields could become more expensive to hold in the medium term. Properties with constrained affordability could struggle to grow once prices catch up with interest rates.

We take these factors, alongside many others, into account when conducting due diligence on properties and projects. This is why we have consistently rejected some markets and properties despite them enjoying strong short-term performance. Don’t allow this short-term performance to cloud your judgement, because property investors are most successful when they play the long game.