Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

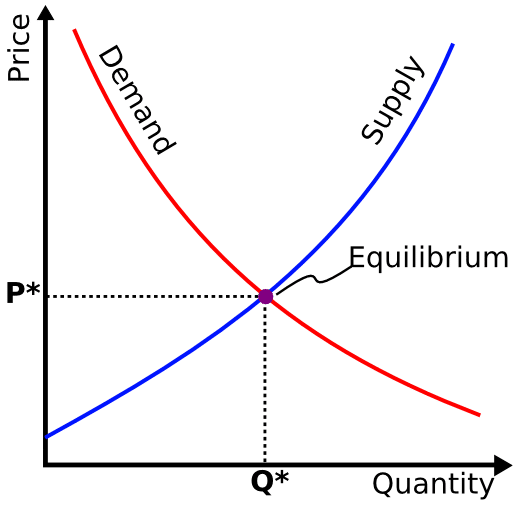

If I asked a random group of 10 investors what they see as the foremost risk of property investment at this point of the cycle, I’d wager many would say ‘supply and demand.’ As always, perspective is key, and education the means of attaining that perspective. I’ll summon all my first year finance knowledge to give you a breakdown of how the supply and demand model works:

The model I describe above doesn’t account for variation in the type of supply. In other words, it’s specific to a single product, say, for example, an iPhone 6 Plus. We don’t see supply and demand analysis that pools together iPhones, Nokia’s, Samsung’s etc. Why? Demand for these products although correlated, is not uniform.

The same is true of property. Demand (be it for resale or rental) for high quality, good value property is unambiguously higher than that for relatively low quality, poor value property. This doesn’t mean that supply risk isn’t real; projected supply in some regions, particular around our capital cities will likely leave demand playing catch up for a number of months. However, supply risk depends almost exclusively on the quality and value of the asset you’re investing in.

Our view, and that supported by research, is that property markets and housing supply move in cycles; Growth phases are inevitably followed by market corrections where we tend to see a period of lateral movement and a reduction of construction. With rising construction costs and increasingly stringent lending policy, the feasibility of some approved projects is already questionable. In fact, The Financial Review reported that approximately 30% of approvals are unlikely to come to life.

What we will likely see in the near term, however, is more lateral rental growth broadly and reductions in weekly rents in areas with the highest supply. Of course, with interest rates at all-time lows, your holding costs are lower now than what they were when rental yields hit their peak in 2012. For the holding costs on a $500,000 property to be as they were in 2012, current rental yields would need to be around 2.9%. That’s just over half (61%) the actual amount (i.e. yields would need to decline a further 40% for your holding costs to be comparable to 2012 levels). Such is the effect of falling interest rates on your costs. It’s all about keeping perspective, really.