Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

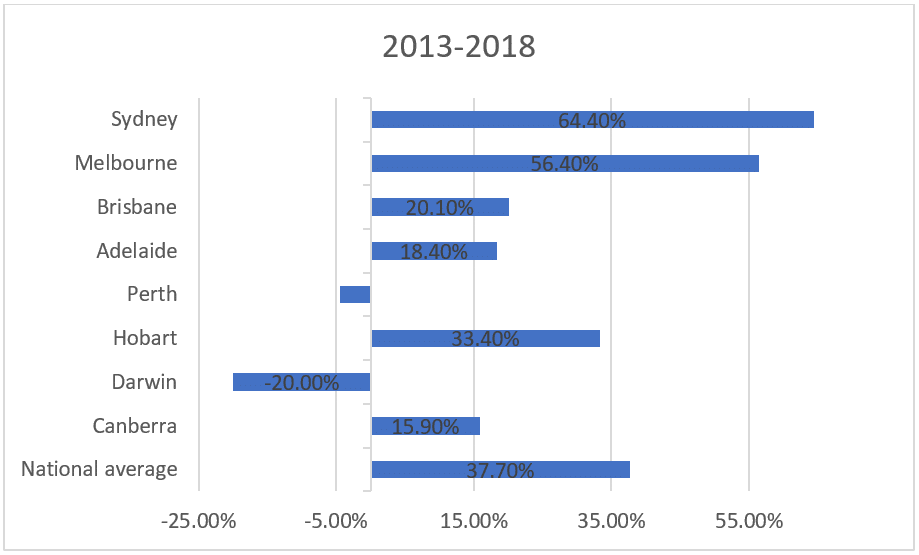

Among investors there seems to be a preconception that Sydney is consistently Australia’s fastest growing property market. In more recent times, this would be correct. Over the past five years Sydney has performed the strongest with dwelling values growing 64.4%. Over the long term, between 2003 and 2018, Melbourne comes up on top – growing a mammoth 335% (Sydney was second, growing at 239%). Although these results speak for themselves, a large portion of Australia’s investors are reluctant to look outside of the Sydney market.

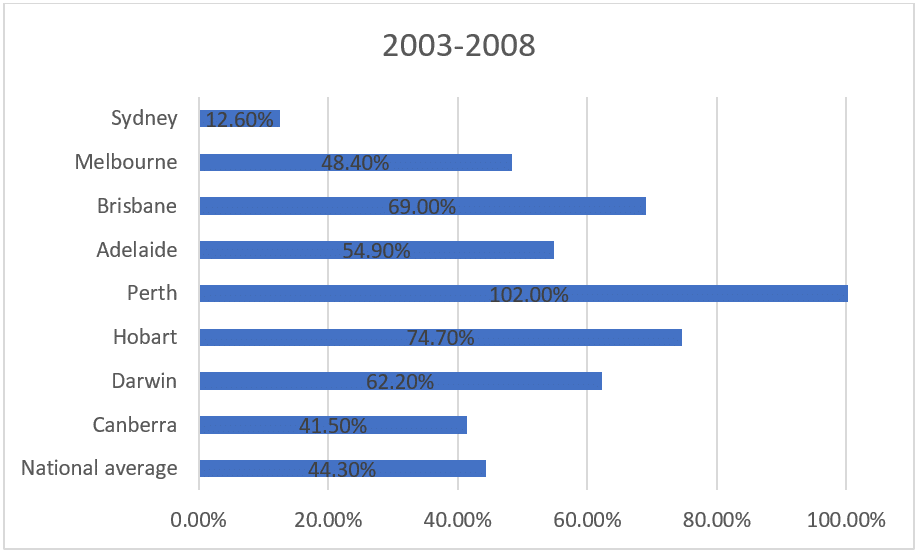

While Sydney has moved at an unprecedented rate since 2013, the recent boom is dwarfed in comparison to what has occurred throughout the previous twenty years. Some of what you would consider to be Australia’s weakest property markets have grown at rates well beyond Sydney. The Australian property landscape is quite unique with our capital city markets performing independently at any given time. Below we assess the capital city market’s performances over a fifteen-year period split up into three cycles.

Source: Corelogic

Since 2013 it is no secret that Sydney and Melbourne have performed strongly. Dwelling values in the harbour city boomed, growing faster than all capitals by at least 10%. Ultimately leaving Sydney at a heightened median price that was expected to stay subdued in its growth over the next five years.

Source: Corelogic

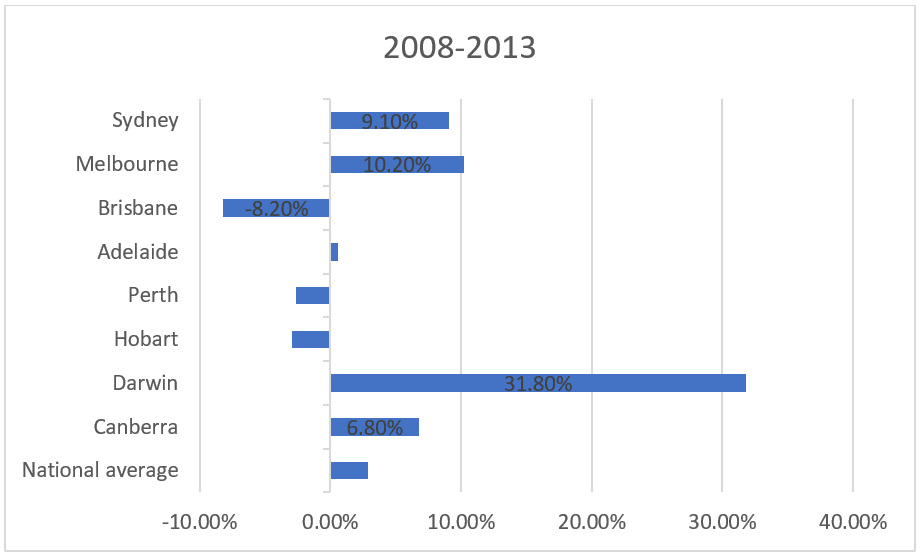

Over the previous five-year period, Darwin grew at a rate much faster than the rest of the nation, during a period where the Global Financial Crisis destroyed the sentiment around many of our capital markets.

Source: Corelogic

Finally, between 2003 and 2008, Perth was the star of the Australian property markets. The Western Australian capital grew nine times faster than Sydney. In fact, Sydney was the country’s worst performing capital city.

Without a doubt, Sydney’s economic performance remains one of the nations strongest, however, the above data reiterates the importance of investing in the right market, at the right time. Sydney’s recent performance has placed a significant strain on property affordability, limiting the potential for future growth. The likelihood is that affordability will drive a shift in demand toward other capital cities. Our research indicates that markets which are currently at a point of opportunity are Melbourne and Brisbane.

At Blue Wealth we aim to select the right properties, in the right markets, at the right time. We take a long-term view in understanding Australia’s cyclical markets. Selecting the right market at the right time allows you to capitalise on growth in various markets. This growth can assist in expanding your portfolio into other markets when opportunities arise and also allows you to diversify your portfolio, mitigating risk and increasing exposure into other markets.