Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

There has been a lot of talk about COVID-19 driving property price movements in regional areas recently. However, it is always a good idea to move a level or two up and look at the dominant themes in order to get clarity. This applies to all markets—be it stocks, commodities, precious metals or property.

COVID-19 is essentially a short-term phenomenon and it can be dangerous to use short term data when we’re purchasing an asset for the long term. In this article we’ll take a deeper look into one of the big driving forces in the property market.

The trend in virtually all western economies is that manufacturing is in long term decline. Manufacturing is a value-added industry and has traditionally been a reliable way to balance the account deficits in a country. This has been the focus of public debate with many governments attempting to boost the manufacturing sector with trade tariffs and subsidies. However, they have failed to make the simple observation that manufacturing jobs, along with many other traditional jobs in regional areas, no longer exist—having largely been replaced by automation. As we move into the fourth industrial revolution, we will continue to see the decline in a variety of jobs. Particularly in transport, clerical work (such as bookkeepers and proofreaders), as well as retail salespeople. In fact, automation is even seeing the demise of some research analysts.

The move towards autonomous or semi-autonomous vehicles in the trucking industry will also have flow on effects. In particular, regional economies where small towns that previously relied on passing trucks to refuel or stop in motels and diners will begin to suffer. This is the normal progression of a post-industrial economy to the point where even China is moving its manufacturing base to places like Africa in order to focus on the production of tech. This, from the country which has built the largest trade surplus in the world off the back of manufacturing over the last three decades.

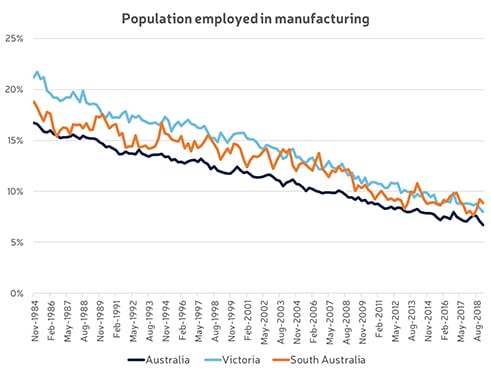

The graph below shows the proportion of people employed in manufacturing in South Australia, Victoria and nationally. It is clear that both South Australia and Victoria were over-represented in the manufacturing sector but have suffered declines in line with, and perhaps slightly outstripping, that of the entire country.

The manufacturing sector was the largest employer in Australia in the 1980s with 16.5% of the workforce. Today it employs less than one million people and accounts for 6.5% of the workforce. Its contribution to GDP peaked at 30% in the mid-20th century, but now only accounts for 5.5%.

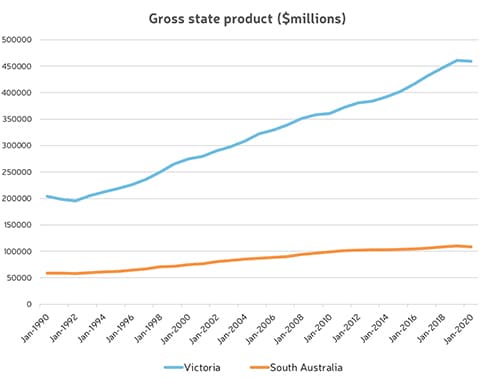

Consequentially, the manufacturing industry which once provided 20% of jobs in South Australia has become decreasingly relevant to Australia’s economy. We have seen a resultant drop in gross state product to the point where its economy has lagged the rest of the country since at least 1985. In contrast, Victoria, where manufacturing was equally important, has managed to replace those job losses with the fast-growing knowledge-based jobs in the service sector. The gap this has created is growing wider as big cities get bigger as the faster growing service sector industries tend to cluster in the same areas. This is not just happening in Sydney and Melbourne. The same pattern is playing out all over the world in cities such as London, New York, San Francisco, Shanghai and even in newer tech hubs like Shenzhen.

It is clear that we are in living through a period of change and accelerating toward a new type of economy. The majority of jobs available in the future will tend toward knowledge-based service industries and these tend to be clustered in major capital cities. Workers tend to congregate in big office towers, technology parks and inner-city universities to collaborate and share ideas. We can already see the flow of human capital and wealth away from smaller regional centres toward larger cities and this is only likely to accelerate over time.

Although Adelaide is a capital city, its property market characteristics closely resemble a large regional centre. Employment in services is under-represented in comparison to their population. Their GSP has lagged the rest of the country, and population growth is forecasted to fall close to zero over the longer term. This has been reflected in the property market with prices growing at or below the official rate of inflation over the long term. While Adelaide’s economy isn’t going to crash, it will face slow to moderate growth for the foreseeable future unless the South Australian government can address the issues facing it and attract human capital into the city.