Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

The introduction of the government pension in 1900 for people over 60 and later compulsory superannuation in 1992 assumed that Australians would own their home outright by retirement age. It was an entirely rational assumption, given the data at the time. Keep in mind that at Federation, only four percent of the population lived past 65. Men could be expected to live to 55 and women to 59 years of age. The problem with organisations is that once rules are in place, they are rarely questioned and are enforced blindly. So, unless somebody dares to ask ‘why?’ these rules tend to continue long after they no longer make sense.

Which is what leads us to our current problem.

As homeownership rates decline and with 40% of Australians retiring with mortgage debt, those original assumptions are failing. What the government of the time couldn’t have foreseen was the insidious effect of monetary debasement, which has always led to a rapid reduction in the purchasing power of money over time. We can see empirical evidence for this nearly everywhere we look, but in particular, it has caused house prices to continue to outstrip wage increases monotonically since at least the mid-1900s.

The Australian Housing Urban Research Institute (AHURI) estimates that 440,000 older households will not be able to find or afford suitable housing by 2031. Retirees in Australia are increasingly using their superannuation savings to pay off their mortgage debt, making them more reliant on the government aged pension to survive. Around 40% of singles and 33% of couples will use their entire superannuation balance to pay off their mortgage debt.

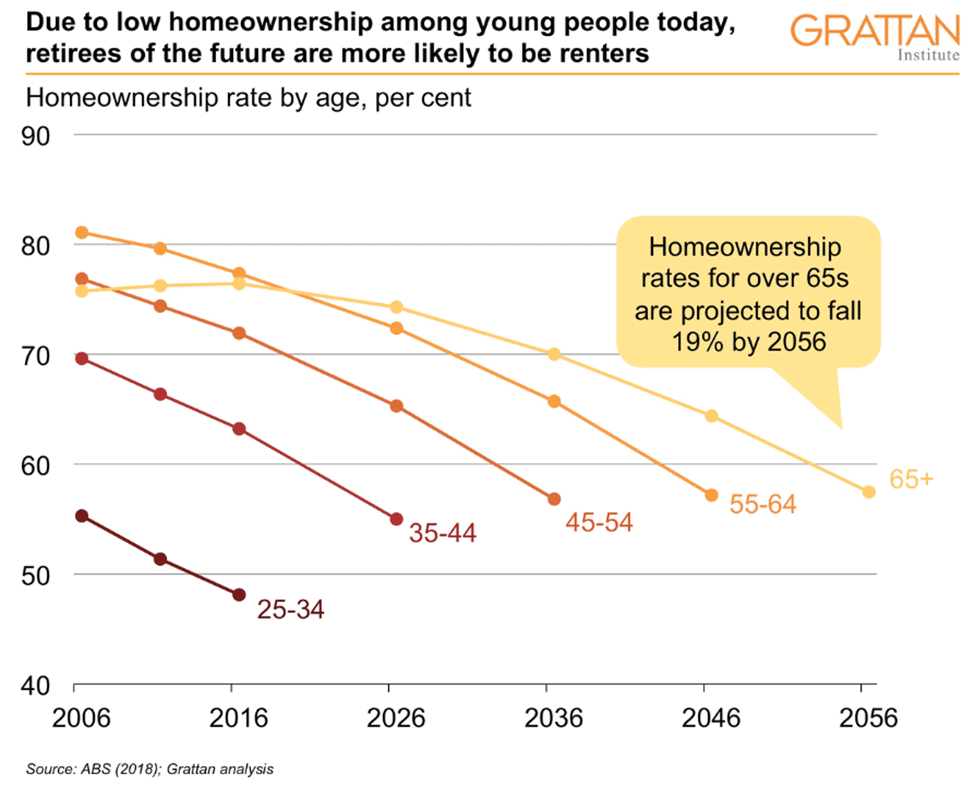

A report released by the Grattan Institute indicated that the proportion of Australians over 65 who own a home will fall from 76% today to 57% by 2056. The implication is that the future looks harder than ever for each younger age cohort. More people will be renting, while others will carry higher levels of mortgage debt. The result of the central bank policies has always lead to the same outcome – a widening of the wealth gap and a hollowing out of the middle class. Unfortunately, we are forced to choose which side of the wealth divide we want to belong to. If we continue along this path without taking action, the retirement system will be unable to cope with the additional load in the future.

As a result, the only real solution is to boost your potential retirement nest egg to supplement your super. And one of the best ways to do this is to invest in property.