Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

I don’t know about you, but it certainly feels like a recession to me. Our household has cut back on spending, and we wait for petrol prices to drop before filling up. Cashflow is noticeably tighter than before and during the pandemic. On the plus side, our assets are booming, with the share market tagging all-time highs this week and the property market continuing to show growth despite the high rates. Pretty much everything has been playing out exactly as expected.

What we see unfolding in real-time is the effect of monetary debasement. It is something that they don’t teach you in Keynesian economics, the type of economics that is taught as the only form of ‘economics’ in university. It’s really no wonder that the government and central bankers with Ph.D.’s and postgraduate economics degrees don’t seem to be able to predict what’s going on with any accuracy. And the reason seemingly endless policy blunders plague us.

When the purchasing power of money falls, you see the effect of this in price rises of goods, services, and assets. The sneaky part is that although your wages might look like they’re going up over time because the number is increasing, the price of goods will likely rise just as fast. And the price of assets will almost certainly be rising even faster. The effect is that even while you see your wages rising, you are getting poorer over time. Which brings us back to the first paragraph… cashflow is tighter, but asset prices are flying. Parking your money in assets is the only real way out of this trap.

Onto other things.

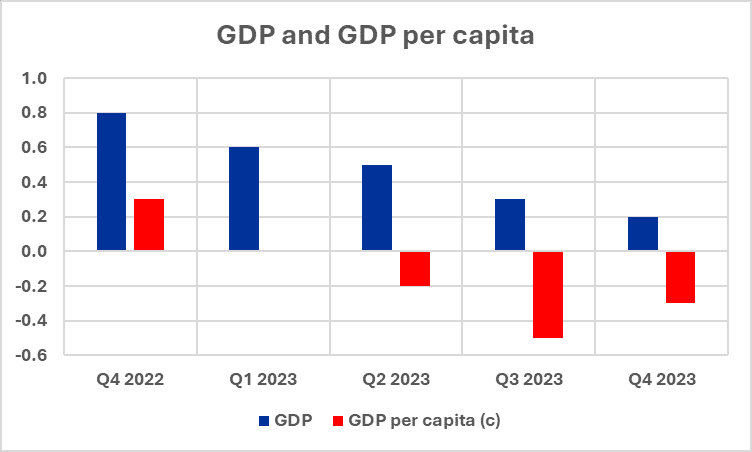

If we look at the GDP figures, it looks like the economy is still showing growth, albeit at a slowing rate, so the government can still claim that we aren’t in recession. But when we divide the growth by the population (which has increased by around 624,000 people in the last 12 months), we can see that at the household level, we’ve already faced four quarters of flat to negative growth. In other words, Australian households have been going backward for a full year.

Some tail effects of this will continue to impact the economy, with the employment market weakening and new job formation slowing. As the unemployment rate rises further, the RBA will be forced to cut rates to stabilise the economy. This will bring a flood of capital into asset markets, and prices will be parabolic. As in every cycle, smart money and institutional investors have already begun to anticipate this move, with the stock market pumping and property prices continuing to push higher despite the difficult credit environment. As always, the best time to buy always feels like a terrible decision; by the time people are confident, prices will already be well on their way to the top.