Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

The RBA has kept the interest rate unchanged today, as widely expected. Today marks the first day of a new era for the RBA, with the board members meeting for two days instead of one. It will be interesting to see if that makes any difference to their policy decisions. I suspect not since the decisions must still be made using backward-looking data.

Today’s decision to hold was based on the fact that inflation was falling faster than the RBA forecasts, with the quarterly inflation figure coming in at 4.1% and the monthly inflation number coming in at 3.4% for December, as we had anticipated. Additionally, the unemployment rate is rising, and GDP growth is weaker. Furthermore, AMP’s jobs leading indicator is now negative, indicating a sharp contraction in employment. Money markets have fully priced in the first rate cut in August and another in December, with a 57% probability of a cut in June. These do tend to flip-flop around a fair bit based on changes in sentiment. Nevertheless, it’s an interesting data point.

On the housing front, the growth in house prices nationally is starting to slow, with prices increasing at a decreasing rate. This should also be a positive sign for the RBA. It should be noted that not all markets are slowing down. Both rents and prices in Perth continue to accelerate. This has been due to the fastest population growth in the country coupled with the fact that it has the lowest median price of any major capital.

Earlier this year, all four major banks in Australia had unanimously called for interest rate cuts of between one and three percent. This is the first time for a unanimous call for cuts this cycle. In addition, the RBA downgraded its own inflation and growth forecasts and upgraded its unemployment forecasts. I guess the picture looks obvious to everyone now.

What else has been happening?

Right now, there appear to be four theatres of conflict around the world which are difficult to understand without knowledge of history to give us a frame of reference. I recently gave a lengthy presentation about this to the Blue Wealth staff and may include it in future blog posts. Suffice it to say that the mainstream narrative is deeply puzzling and doesn’t seem to stand up to logical rigor.

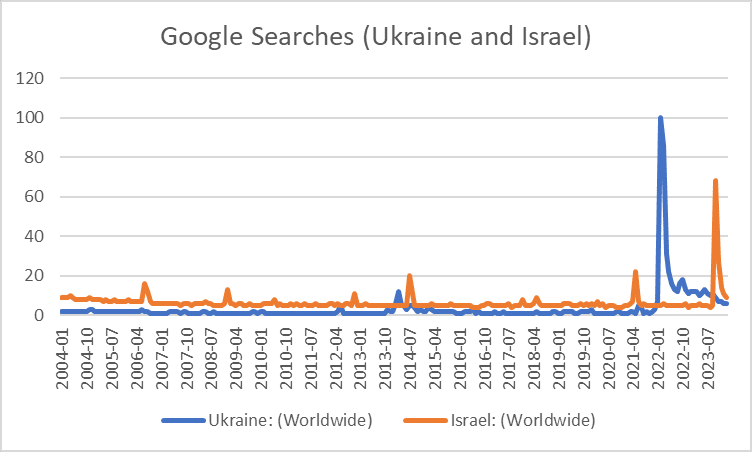

For now, the main area of interest is the Middle East, with the Biden administration and media having largely forgotten about Ukraine and Russia. We can see this clearly in the Google Search trends.

There has been an escalation in the fighting between the Houthis in Yemen and the US as the Israel-Palestine conflict begins to spill out into the wider region. The US has now struck targets in Iraq and Syria, although it’s obvious that the current conflict is effectively a proxy war between the US and Iran. Two countries with a history of conflict going back to at least 1952 with the overthrow of Iran’s democratically elected leader Mohammad Mosaddegh by Kermit Roosevelt Jr. (former president Teddy Roosevelt’s grandson). This was a joint operation between the CIA and MI6, and it resulted in the takeover of Iran’s oil industry.

There hasn’t really been any fallout from this that we have felt, with West Texas Intermediate (WTI) Brent Crude Oil prices still sitting around $72. In addition, the Houthi blockade of US, UK, and Israeli cargo through the Red Sea has only added around 1-2% in costs to final goods for containerised freight between Asia and Europe. However, the last stages of an empire are typically marked by major conflicts, both internal and external; we’ll continue to watch this space closely to see how things pan out.