Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

I have to preface this with the fact that I recognize that lots of people probably want to see the monthly moves in property prices. But I consciously try not to report on them often. They’re not a very useful indicator for the investment time horizons we are typically dealing with. In contrast, it normally ends up confusing people and bogging them down in detail. In investing you can have two people holding the opposite opinion on the market and both can be correct simultaneously…. The only difference would be the time horizon they are referring to.

For example, a day trader looking to make a move in a few hours or days may be bearish on the market, while a macro investor who is waiting for a big cyclical turning point, could be bullish despite the small intra-day moves on prices. In property, we can’t really trade it effectively due to the slow-moving nature of the sales process and the high transaction costs (such as stamp duty, agents’ commissions, marketing fees, etc.) so we are then pushed into these long-time horizons. The fact that it’s such a pain in the arse for people to sell is a big part of the reason why property investment is such a successful strategy for many people. It stops us from doing dumb things at the wrong time.

With that out of the way let’s have a quick look at monthly prices.

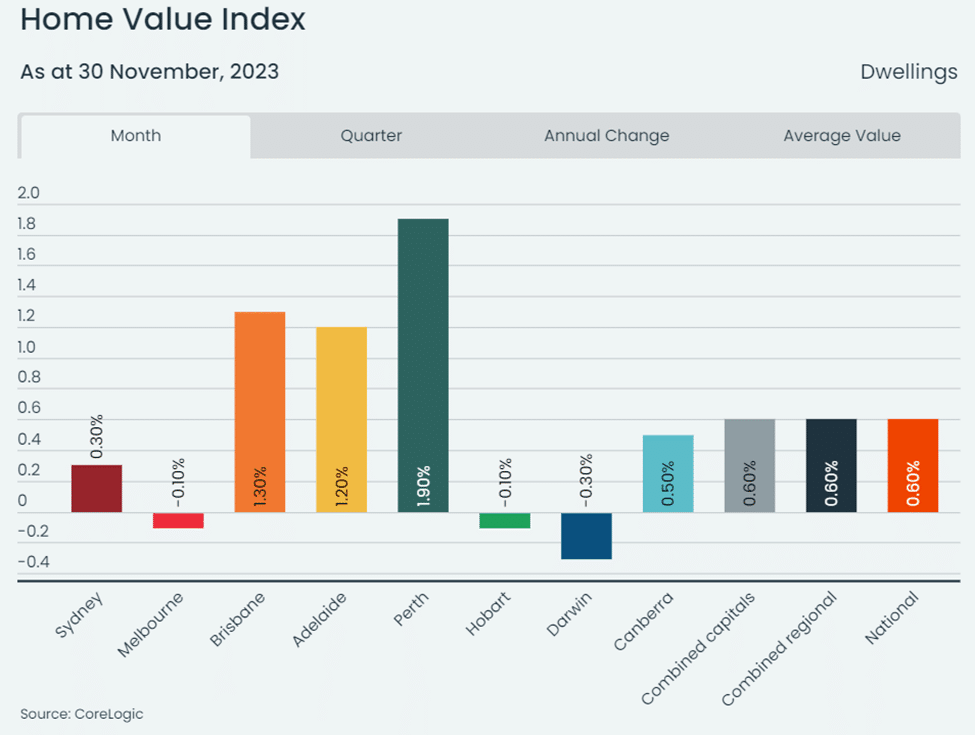

In November price growth rose by just 0.6% – if we were to annualize that it would imply a growth rate of around 7% per annum (or right on the long-term average). While this seems like a decent result the price growth hasn’t been evenly distributed across all states. Melbourne, Hobart, and Darwin moved into negative growth for the month, and Sydney looks like it will follow soon. Brisbane and Adelaide have held their growth rates steady, and the big winner has been Perth which has bucked the trend by accelerating to its largest monthly increase in growth in nearly three years.

Interestingly November is also the first time in the last six months where the pace of rent growth has outpaced capital growth. An increase in yields (albeit slight in this case) is healthy for a property market that probably needs to take a breather. Overall, there really isn’t much more to say about this other than the fact that Perth continues to run hot points to it being in a deeper level of technical undervaluation than the other markets. Of course, there is increasing evidence that we are now on the cusp of a new global commodities supercycle driven by lithium and associated battery minerals (of which Western Australia has the largest global reserves).

If we zoom out and look at the price action over a multi-decade timeframe it’s extremely clear that we are just in a mid-cycle consolidation phase. There is really nothing much to report on. It looks like the RBA has overcooked the interest rates as it always seems to do, when the rates drop next year, it will usher in the final and biggest leg of the bull run for this cycle which will top out somewhere around 2026-2027.

Buying now is money-making on easy mode, but as always, the vast majority will miss out and begin to FOMO in after the market is pumping. What I find most fascinating about investing is the seemingly immutable nature of humans, this herd behaviour is what gives the market cycle its shape over time. And we can observe the same shaped graph not just in property, but in all kinds of assets, spanning hundreds of years. This means that generation after generation we tend to make the same dumb investment decisions. The good news is once you’re aware of it it’s easy enough to break the cycle…. I wish you all the best!

Gavin Chau