Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

With the price rises of lettuce, petrol, building materials, wages, rents, and just about anything you can think of lately, the topic of inflation keeps popping up. Of course, the response by the central banks is to raise rates. This has taken the heat out of risk on assets such as shares, cryptocurrencies, and property.

In past cycles, real estate prices have tended to continue to rise even as interest rates increase. This is because the fundamental driver was a demand-side push. This time growth has slowed and even reversed in about 40% of the market nationally – primarily in the premium suburbs. As we have been saying, the difference this time is that price rises aren’t a result of excess demand. They’re a result of a supply-side shock stemming from the rolling pandemic lockdowns and the war in Ukraine. The rate rises have been killing demand where the real issue has been a supply shortage. However, the case for the economy to be approaching peak inflation keeps getting stronger.

I’ve been tracking the price of building materials since last year and the global commodity prices of freight, steel rebar and timber are all way down from their peaks. However, when you speak to the end user (builders and developers etc.), they’re all saying prices are still rising. The only possible explanation for this is there is either a lag in the system and the building supplies being sold now were produced at the higher prices, or alternatively, somewhere along the supply chain, a middleman is making a killing! Either way, we should expect the lower prices to flow through to the end user eventually. If there is competition in the market for building supplies, the “invisible hand” of the market will eventually lead to undercutting and price drops.

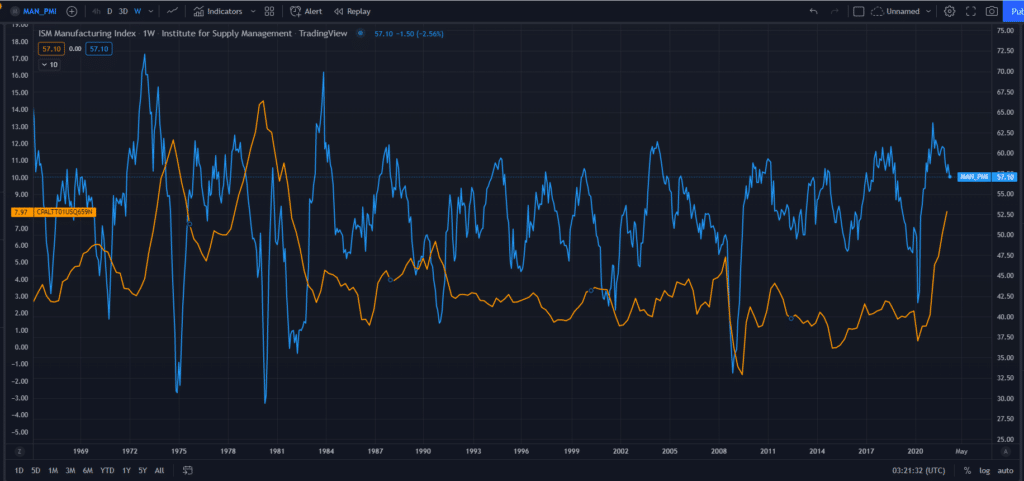

Additionally, the purchasing manager’s index in the US (in blue) has already peaked and is on its way down. The purchasing manager’s index usually leads the Consumer Price Index (in orange) by 2-6 months. It’s important to note here that CPI is a lagging indicator showing us what has already happened rather than what’s happening right now. So, while the CPI may still keep rising for a little while, we may be at peak inflation in the real world already. All the dominoes are already in place for a drop in the CPI print.

Asset markets are forward-looking, and we can expect them to begin increasing in anticipation of interest rate drops before we officially see peak inflation. Corrections are healthy and a normal part of the market cycle they serve to flush out any excesses and misallocations of capital so that the bull run can continue. In the meantime, the increases in building materials have seen developer margins tighten considerably. Many have shelved projects, so supply has rapidly dried up all over the country. I can’t recall seeing the market move from an oversupply to an undersupply in such a short time, and we’re already seeing rents and yields pushed higher.

Our view remains that interest rates will stabilise towards the end of the year or in the first half of 2023, which will usher in the second half of the bull run on the east coast. This is where we will see the best gains of the cycle. When we’re in a macro uptrend, all we need to do is buy good property and wait for the market to come to us.