Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Population growth has a self-evident impact on housing: if more people live in Australia, there will either need to be more homes built for them, existing homes will become overcrowded, or homelessness will skyrocket. This is why Population and Demographics feature prominently in our research model.

Although we have established that a growing population naturally implies demand for more housing, we can go a step further by identifying where in Australia this population growth is occurring and who these new additions to our population are. This week, we are going to break down the characteristics of the latter. I.e. exactly who is joining our growing population and why should property investors care?

Natural increase

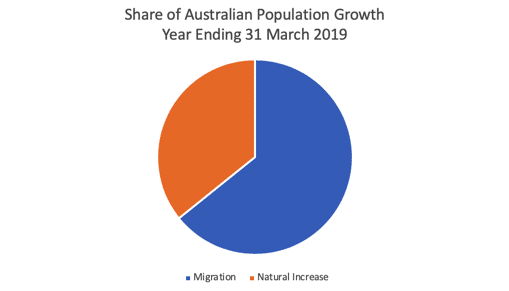

Many countries around the world are struggling to sustain their population through a natural increase (childbirth outnumbering deaths), with birth rates reported as low as 1.0 in places like Hong Kong. To sustain a population, the birth rate needs to be maintained above 2.1 which Australia is also well short of at around 1.93. The Australian Bureau of Statistics estimates that Australia’s natural increase in the 12 months to 31 March 2019 was 139,100 people. This represents just under 36 per cent of Australia’s total population growth over that time.

Source: Australian Bureau of Statistics, Blue Wealth Property

Net migration

Australia is often espoused as one of the world’s greatest migration success stories. The entire human population of Australia are migrants or descendants of migrants from some point in the last 60,000 years. The majority of Australia’s population growth occurred after the Second World War, which has been accompanied by many other major changes such as air travel, communications technology (the internet) and family composition. Between European arrivals in 1788 and the Second World War, Australia’s new migrants were almost entirely from the British Isles. Data from the Department of Home Affairs suggests this has changed substantially. United Kingdom migrants now account for approximately 8.4 per cent of Australia’s annual intake of the migrant program, as opposed to 29 per cent from Southern Asia (India and surrounds) and 17.4 per cent from East Asia (China and surrounds).

In the 2017-18 financial year, Australia welcomed 111,099 skilled migrants, 47,732 family stream migrants, as well as 3,350 child visas. Close to 100,000 of these migrants stated their intended state of residence as either New South Wales or Victoria, which mirrors the level of net overseas migration in these states. The top five occupations of the skilled migrants were:

Other migrants in Australia are temporary visitors which include students, working holidaymakers, temporary workers and tourists. These temporary entrants typically represent between 5 and 10 per cent of Australia’s population at any given time, with a peak in the summer months. Australia is also one of the world’s largest havens for refugees.

Why does it matter?

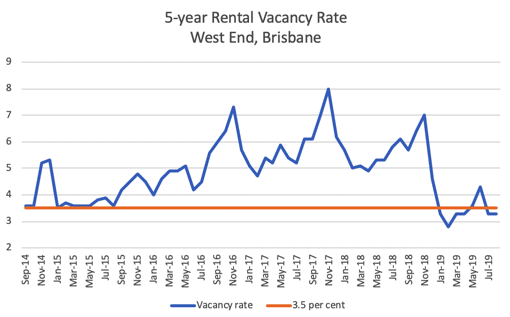

Just a few short years ago, some fear mongers in the property industry argued that the supply of new housing in places like Brisbane, Melbourne and Sydney would lead to significant vacancies and oversupply. Even in areas with a stronger supply pipeline such as the inner-Brisbane suburb of West End, the new supply was rapidly consumed by a growing population. In fact, the 5-year peak vacancy rate of 7.3 per cent in November 2016 had plummeted to 4.7 per cent within three months. Over 2018 and 2019, the vacancy rate had fallen further to the range of equilibrium.

Source: SQM Research, Blue Wealth Property

The take-up of West End’s 2014-18 new housing pipeline can be understood through the lens of product-to-market fit. In other words, the transformation of this inner-city suburb to meet the demands of its growing population was an effective marriage of property supply and population growth which created a balanced market in a few short years. By understanding the demographic characteristics of those fuelling population growth in certain areas, we are better able to anticipate what kind of properties they prefer to live in and thus, where demand may exist in the future.