Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

When purchasing an investment property, a crucial part of asset selection should be based around the future demand of tenants and buyers. After all, the world around us is continually changing and anyone who has lived in Australia for the last thirty years can tell you how much. Therefore, as an investor you should be assessing what is likely to induce the highest demand when it comes time to rent or sell.

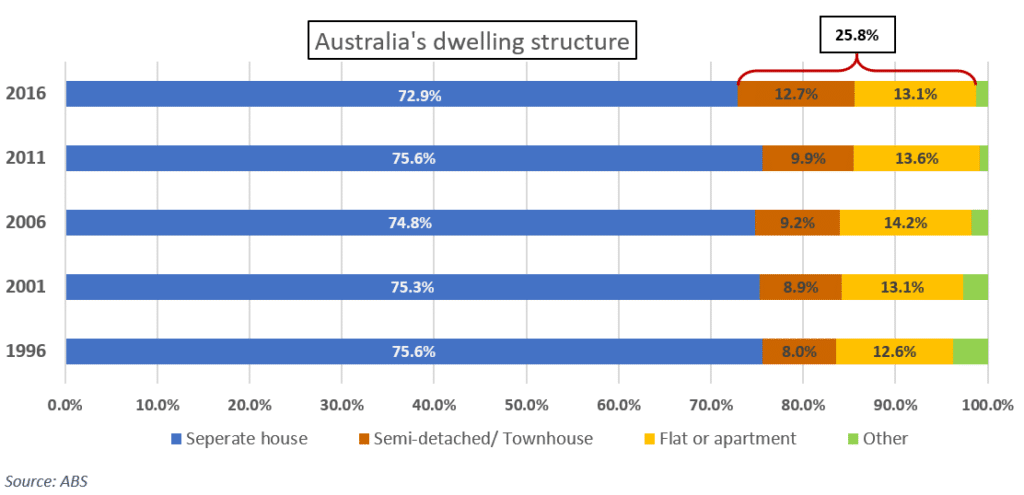

Australia’s capital city property markets have been shifting from traditional quarter-acre blocks to apartments and semi-detached dwelling for decades. There has been a renaissance in the acceptance of high-density dwellings in our state capital markets, with over a quarter of Australia’s residential dwellings now being apartments or townhouses.

Over the last three decades the average household size has shrunk to 2.6 (one whole person less than it was fifty years ago); comparatively the proportion of Australia’s attached dwellings has grown by over 5% since 1996. Although this may not seem like a significant shift, 5% growth accounts for an additional 488,000 dwellings – that’s more than double the number of dwellings in modern-day Tasmania.

So, where to next for our capital property markets? Will they progress into something mirroring New York and London where attached dwellings hold the lion’s share of the market, or will we move outwards towards a more horizontal urban sprawl?

No on one has a crystal ball to predict this, however, population growth is a good future indicator. Australia’s population is forecast by the ABS to hit twenty-five million this year (thirty-four years before initial expectation), with our four largest states containing over 88% of this population for the last fifteen years. This large ongoing influx of new residents and the continual debate around housing affordability has led experts such as economics firm Urbis to forecast our largest markets to move towards an era of medium density, high quality living. This evolution will bring a myriad of economic, social and environmental benefits.

As we move towards a future where apartment living is even more the norm, complexes that provide premium resident facilities will be more sought after. Lifestyle amenities such as gymnasiums, pools, restaurants and bars are examples of those that had previously been a rare addition to apartment blocks.

Ultimately, high-quality properties will rent, sell and withstand the trials of property markets. Now, more than ever, it is crucial to select the highest quality properties to capture the future demand of Australians. Our goal is to find these properties for our clients within Blue Wealth approved suburbs and to help create strong portfolios that outperform the ever-changing economic landscape.