Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

Remember the days when making your playlist consisted of sitting a nose away from your boom box, listening to your local radio station and holding your fingers steady and ready to hit the red record button as soon as your favourite tune came on? You’d dance around the lounge room a little then run like a mad person back to the boom box to hit the pause button right before the song ended so you didn’t record the voice of the radio disc jockey.

For me, and I’m sure for a lot of you, life right now feels like we’re trying to make a mixed tape.

We have no idea what’s coming up next. There’s way too much talking compared to music and just when you think you’ve almost filled up side B, they keep repeating the songs you already recorded on side A! The constant play/pause of life is happening across so many areas of our lives and let’s be honest, it’s going to linger around for a while longer.

In a sense, most of us Aussies have now grown a-custom to this way of life. Making plans now incorporates the constant possibility of the pause button. Decisions are measured and evaluated from every angle. Assurance and spontaneity have pretty much been punched in the face – hard!

So what is this play/pause button of life doing to our rental market? The short answer is… we’re stuck on pause.

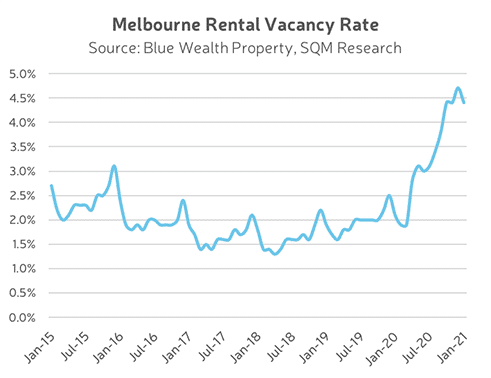

Yes, we all know that vacancy rates have risen, especially in Sydney and Melbourne. We also know that the vacancy rates peaked in December 2020 due to the unforgettable Melbourne lockdown, the stop of international students, the influx of short-term lettings fighting for long-term tenants and job losses causing tenants to move back home. Along with these elements, we now compete with flexible work from home arrangements, tenants moving further out where rents are more affordable and government incentives (almost $50k worth) aiding tenants to become homeowners – not just in regional areas but our cities.

So when I’m asked by my landlords why their apartment is still vacant, we discuss these very things and reminisce about the good old days where tenants would be lining up around the corner to inspect apartments.

A high vacancy rate will always angle the shift of the rental market. The more properties that are available = the more choice tenants have = the more time tenants take to make a decision = longer vacancy = days on market = loss of rent = reductions of rent = market shift.

So for now, this is the new way of life. Businesses and industries all around us have adapted and diversified to survive. So as investors and landlords, we need to do the same. But, what if I told you we can change the radio station?

For the past 8 weeks, I’ve been tracking the rental market in one specific area. Vacancy in this particular location hit a high of 5.4% and pre-COVID yields were an average of 4.8%. Strategically, our landlords shifted the rents in line with tenant demand. Rents were reduced between 10 -15% some even 18%. In a time where we were are at peak vacancy, adjusting the rent swiftly and concisely enabled us to hit the record button and keep dancing.

Tenants’ attention was captured and started to attend open for inspections in numbers. These weren’t the tenants who had time to play the market, but the tenants who had good quality secure employment and knew that these rent reductions will be temporary and only a matter of time before they started to increase again.

Our landlords were brave and trusted the advice that was given to them. They were informed and made decisions as if they were running a business. Reducing the rent quickly and swiftly would attract a tenant faster – which would reduce the overall out of pocket vacancy AND the best part was it reduced the overall vacancy rate for the area.

Now, this very same area is booming again. Vacancy rates have plummeted and demand is high.

Let me be clear, yields are still not where they were pre-COVID and they won’t be for a little while longer, but as investors, we need to be smart and brave.

Right now, I am encouraging all of you to be strategic. Minimise your vacancy wherever you can. Shift the rent in line with current market demand. Have a conversation with your property manager about securing your current tenant longer. Incentivise them to sign another 6, 9, 12 or any number lease term. Every time your tenant vacates you incur the standard letting fees and marketing fees. Securing your current tenant will reduce these fees and eliminate any vacancy exposure.

If your property manager hasn’t already had this form of conversation with you then please call me.

On average 75% of tenants vacate at the end of their lease. That’s a normal market change that we as landlords will always have to compete with so let’s survive this thing and be flexible and diversify.

This market shift is short term. Tenants know this. It will pass.

We have all heard Dr Tony Hayek say it time and time again, ‘hold property long term and don’t get sidetracked by the noise’. This is just noise. Before you know it, we will be back dancing to our favourite non-stop hits.