Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

It seems that we’ve had quite a few questions relating to the Perth housing market from the blog posted a fortnight ago, so let’s take a deeper look at the macro drivers. From the previous article, we’ve established that the Western Australian economy and housing market have had a heavy reliance on Chinese demand for commodities. I think the market can do quite well in the next housing cycle, but at some point, in our lifetime China will run into a demographic timebomb. Let’s have a look at how this could potentially play out for property prices in Perth.

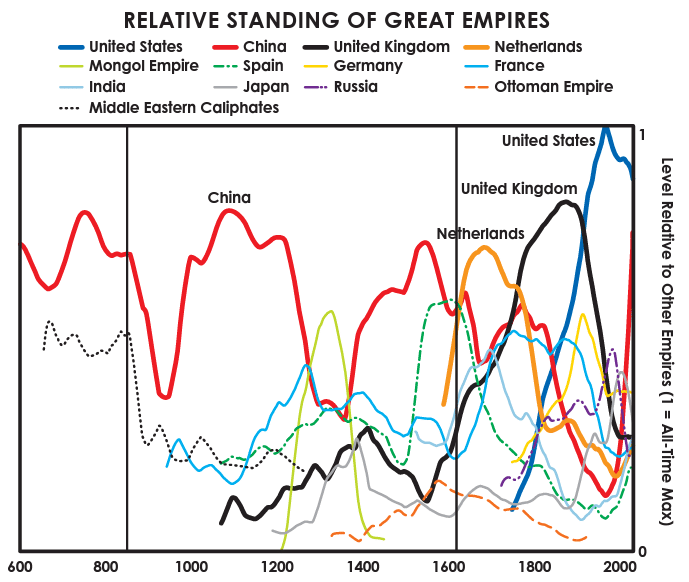

The best investors are always keen students of history. The story of China, Japan, Korea, Singapore, and most of East Asia is the story of globalisation and industrialisation. Below is a graph of the relative standing of great empires from Ray Dalio’s brilliant book ‘Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.’ Ray Dalio is a legend of macro investing, and unlike like central bank academics, his approach to investing is pragmatic and based on reality.

From at least 600ad China has been the global hegemon, the most advanced nation in the world in regard to innovation and technology, and the country with the highest GDP. After sailing around the world around 1400, they were convinced of their superiority regarding the rest of the world to be living in various states of barbarism. Their huge mistake was burning their naval ships in 1525, closing their doors to the rest of the world because they believed that there was nothing the world had to offer.

In doing so they missed out on the industrial revolution in the West, which saw an explosion of productivity and the mechanisation of workforces (creating factories, replacing horses with cars, use of electricity, etc.). We can see that from 1600 the Netherlands became the hegemon for 100 years, then the UK Empire for 100 years, and finally the US Empire. The current and arguably the most powerful empire that has ever existed has been in power for around 100 years.

China has since spent the last 40 years trying to catch up – doing what the West took 200 years to do. This is why their steel and energy demand has been so high. And also why Gina Rhinehart is a multi-billionaire.

The process of industrialisation has always resulted in the movement of the population away from farms and into cities. In Asia, this happened en masse since the population densities pre-industrialisation were already among the highest. This meant that mega cities arose and, with them, of course, the demand for iron ore.

But the problem is that the move away from an agrarian society to an urbanised one means falling birth rates. It’s why every industrialised country on earth has a declining population. The implication is that after the initial explosion in construction, the requirement to build new buildings and infrastructure will decline with the population. And with it the consumption of steel and other commodities.

Japan and Korea are useful analog cases for China, both having moved through the process of industrialisation more rapidly. Both have very low birth rates and declining populations. And both have moved from farming to manufacturing and finally to tech. Exactly as China is doing now.

By 2029 China’s population is expected to peak. Incredibly, the Shanghai Academy of Social Sciences team predicts that China’s population is expected to halve by 2100. While energy consumption will likely continue to rise, steel intensity will invariably decrease. The bullish case is that the manufacturing bases China is currently building in Africa will take up the slack in steel demand, and the Perth economy will continue to do well. The bearish case is that it will take some time for this to happen, and the Perth economy and population growth will lag the rest of the country in the meantime. While I can’t deny that Perth might do well, I think there are safer markets to deploy our capital into for the time being.