Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

For the past five years, property investors, including many of you reading this now, have enjoyed almost utopian conditions such as low rates, limited competition for properties and increasing yields. Of these, yields have received the most media attention of late.

Yield is the relationship between rental income and the price of your property. Here’s an example:

Say you have $500,000 property renting at $500 per week. Rental yield on this property is:

($500*52/$500k)*100 = 5.2 per cent

What happens if the price of the property increases to $600k and rental income remains the same?

($500*52/$600k)*100 = 4.3 per cent

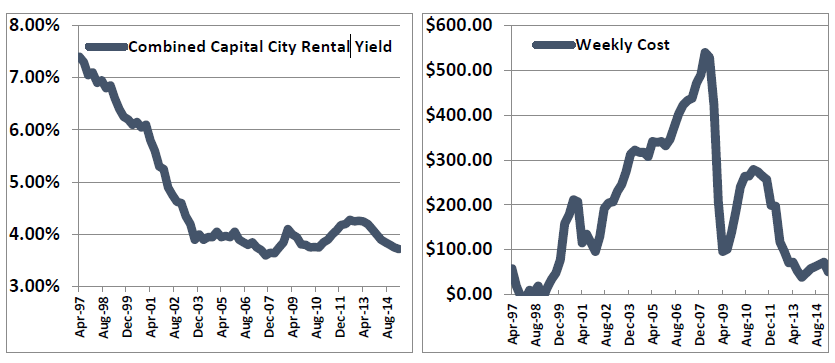

In markets where prices grow quicker than rents, yields decline; as has occurred in most of Australia’s capital cities. The blue line in figure 1 below shows the combined capital city rental yield during the 18 years to December 2015. The most significant erosion to yields occurred between 1996 and 2004 when combined capital city dwelling values surged by 142 per cent while rents rose by only 25 per cent; the result? Yields virtually halved, decreasing from 7.8 per cent to 4.0 per cent!

In the few years after the GFC, construction approvals hit an all time low resulting in severely constricted new supply and upward pressure on yields. The recent property upswing, however, has dampened yields yet again. In the current environment, we now have three forces driving down yield;

1. Capital gains are exceeding rental appreciation

2. Rates are lower spurring renters to buy – decreasing the amount of potential tenants

3. Developers are capitalising, with approvals at all time highs – increasing dwelling supply

Before you all run for the hills in fear of the impending rental apocalypse, note that as an investor, a 4.5 or even 4 per cent yield when you are paying under 5 per cent interest is still costing less than $100/week. Also, with this increased demand, prices are shifting and, ultimately, growth, not cash flow, is what will make you wealthy.

The weekly cost in figure two is based on a $500,000 property where costs are calculated as

Income-Costs/52

Income = rent per year and Costs = interest on loan per year

The effect of falling interest rates on your costs is more significant than that of falling yields on your income, meaning holding costs declined in light of falling yields! Add to this the power of leverage and compounding and there can be no doubt you are still investing your money in the right asset class.