Please fill out the details below to receive information on Blue Wealth Events

"*" indicates required fields

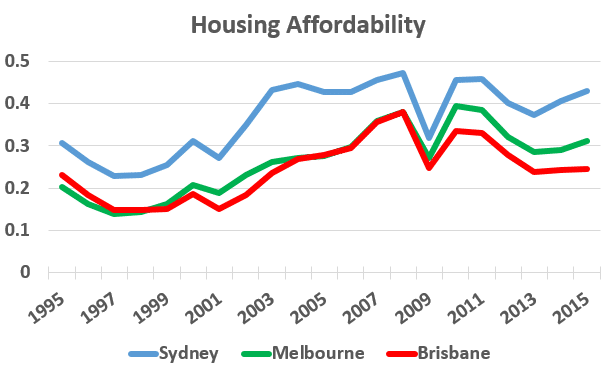

My professional career has been characterised by a four year Sydney property market growth phase, a period that, generally speaking, now appears to be nearing its end. I for one am excited by the prospects a change in market conditions brings! The situation we now confront is one of an unsustainable affordability gap between our capital cities. The figure below tracks the change in the proportion of income an average household spends on its mortgage payments over the last twenty years.

Brisbane and Melbourne are more affordable now than they were at their respective cycle highs of 2007 and 2010; Sydney, however, is approaching the precipice of its historic unaffordability peak. The average household in Sydney now spends close to 44 per cent of its weekly income on mortgage payments, while in Brisbane and Melbourne you’re more likely to spend between 25 and 32 per cent. Sounds enticing. Of course, these markets will not be driven by affordability alone; employment opportunities, population growth, amenity and local infrastructure, among other factors, will also be important. Affordability, however, is a foundational philosophy of the Blue Wealth research process and the one on which our analysis of market timing (the ‘right time’ for all who have been to a Blue Wealth educational seminar) is predicated.

I began this year’s blog posts by asking you to keep perspective a lesson that remains as important now as it ever was. Let’s try to avoid making generalisations that prove to be road blocks to our investment aspirations.